5 reasons financial reporting software is impossible to ignore

The finance team is the central nervous system of your business primarily responsible for making finance-related decisions. It can deftly interpret your external environment as well as keep you balanced.

Without funds, an organization can’t breathe. Yet, instead of contributing expertise to all business decisions, the finance team spends much time preparing static reports. The rest of the business is siloed from the numbers, prolonging action to address issues. This blog will address why financial reporting software can’t be ignored - freeing up the vital resource of financial know-how.

1. Accessibility to financial numbers

Any key business decision is heavily dependent on the financial numbers and data analyzed by the finance team — the organization can survive and thrive only if the finance team provides insights timely to the managers and decision makers.

However, in most organizations, the finance team spends a majority of its time transferring data from ERPs in spreadsheets, applying tons of formulas, and creating static reports for the users.

Since financial data is kept too siloed, the users have to come back to the finance team for any query or clarification which delays the decision-making process unnecessarily. The financial reporting tool syncs the data to the statements so the users can themselves identify answers to their questions.

2. Educate others about financial performance

The finance function is not restricted to reporting financial results anymore. In the fast-changing world, the finance team can help mitigate unforeseeable risks, discover hidden opportunities and delivering business results.

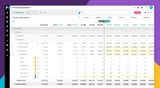

Using financial reporting software, the finance team can provide customized financial statements in different formats and layouts to suit the audience in just one click. Also, they can add complex calculations to provide better insights.

The finance function can adopt an enterprise-wide view and educate everyone in the company by creating live dashboards so they can visualize the current situation with graphs and gauges — and share with others.

3. Financial reporting software — a friend (and an assistant)!

Want your finance team to ditch repetitive, mundane tasks and focus on value-added analysis? Adopt a financial reporting software.

“But will it eventually replace my finance team?”

No, it won’t.

The finance team will still control everything happening inside the ERP. Your general ledger will remain untouched.

Instead, the financial reporting software pulls data from the ERP, processes it, and automates the entire process to create live dashboards and customized user-based financial reports.

Result? — The finance team can focus on analyzing data, finding patterns, and reporting to the managers who can make better, timely decisions.

4. Added control and security

While customizing and automating reports, the general ledger remains under the tight control of the finance team. A finance reporting software gives the finance team the authority to set up user permissions to govern the level of detail each user can see.

5. Compatible with spreadsheets

Additionally, a good financial reporting software also knows finance’s affection towards spreadsheets. Hence, it ensures seamless integration so the finance team can download reports into spreadsheets without affecting the hierarchy and formulas.

Phocas financial statements can be your ultimate financial reporting software for making your finance team modernized and more productive.

Ideally, your financial statements solution will work in tandem with your business intelligence software and ERP to facilitate the sourcing and management of data. Phocas Financial Statements, for example, is an add-on to Phocas business intelligence software and integrates with a variety of top ERP systems such as Infor, Epicor, Microsoft, MYOB, Oracle and SAP.

To find out more about the new financial reporting, download this ebook: Turbo charge your finance team to value add

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

When to use an operating budget for more detailed planning

What is an operating budget? An operating budget is a resourceful tool that enables businesses to estimate income projections and expected expenses and plan for low-earning or high-spending months. This financial plan provides data that constantly records the costs of your business operations for a specific period (mainly up to the end of the year). It also serves as an outline detailing how much money a company spends and incurring expenses.

Read more

Best practices for cash flow forecasting

Whether you are managing inventory or planning an acquisition, to maintain day-to-day operations you need a clear cash flow forecasting process. Staying on top of cashflow means you can gauge your solvency and profitability from a long and short-term perspective.

Read more

Improve planning with comprehensive sales forecasting

If the owner of your business wants to expand to a new State, would you have the sales forecasting figures to know whether the business can afford to do that or not? Or, if you had to produce a 3–year solvency projection for the CEO, is your sales forecasting process robust enough to support a reliable analysis?

Read more

What is financial modeling and common models to know

Predicting the future is a daunting task, unless you possess a time machine like Marty McFly in the 1985 film, 'Back to the Future'. If you don’t have such a tool, the next best thing is financial modeling. It can offer valuable insights and guidance into the future financial position of your business.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today