Netsuite financial consolidation software

Financial consolidation for Netsuite

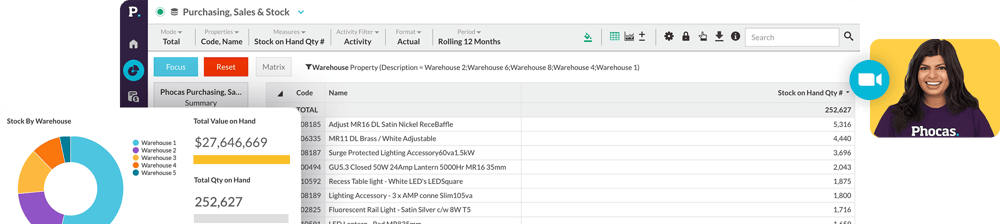

- Efficiency: save hours, even days of data wrangling with financial and operational data automatically consolidated

- 360 view: data is pulled from multiple ERPs , subsidiaries, branches, countries into one consolidated view

- Compare: Quickly switch from a high-level overview to analyze against division, time period or branch

- Migration: can be quickly implemented to provide uninterrupted dataflow, reporting, dashboards during ERP migrations.

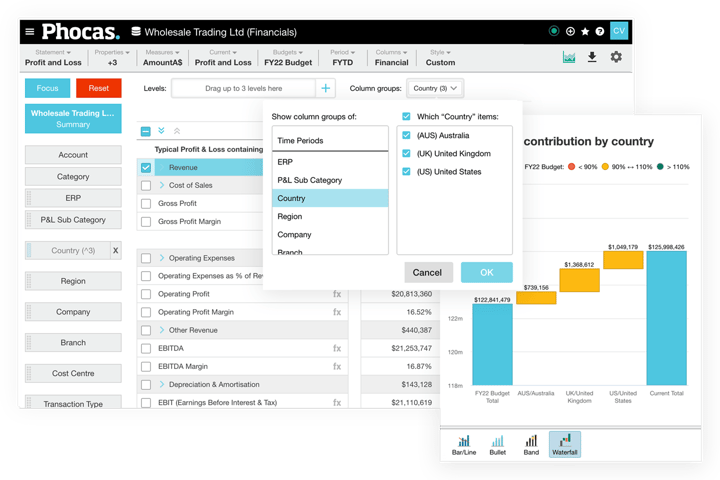

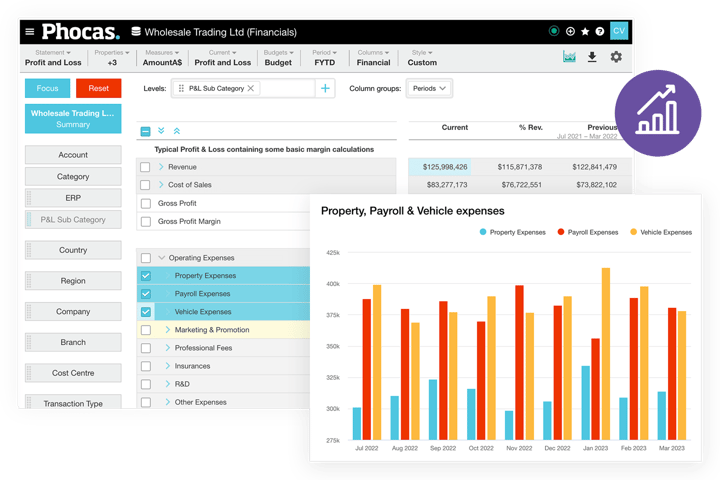

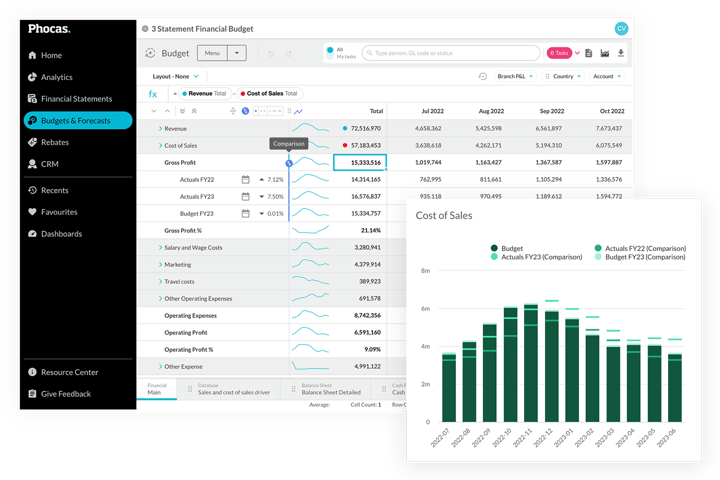

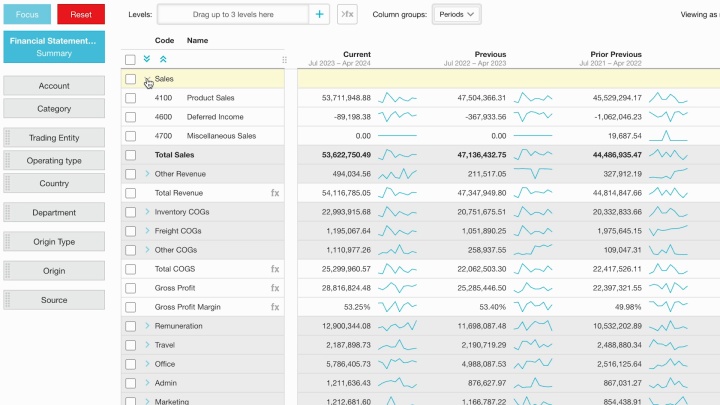

Self-serve financial reporting

- Easy: create and automate profit & loss, balance sheet and cashflow statements for cross-functional teams in minutes

- Accurate: reports update automatically with data pulled directly from your Netsuite ERP + any other source

- Self-serve: drill down into transaction-level data and drive improvements by branch, division, sales rep, product, customer

- Customize: add visualizations or calculations such as EBIT, margins and ratios that auto update.

Detailed budgets reveal growth opportunities

Using Phocas, Savona Food Service has moved away from manual reporting and limited visibility of budgets. Now with automated reporting and quick, easy access to all their data including budget actuals, sales teams are more proactive and hitting targets. Plus, budgets are now built at a granular level, revealing more growth opportunities.

Streamline FP&A for Netsuite

- Time-saver: a user-friendly planning tool that speeds up budgeting and enables you to get more detailed

- Accurate: use live actuals pulled from your Netsuite ERP to accurately forecast your future balance sheet position and financial health

- Consolidate: connect plans across the business in one place; financial budgets, sales forecasts, headcount and demand planning

- Collaborate: improve cross-functional input and accountability with robust workflows and user-based permissions.

Designed for Oracle Netsuite

Netsuite is a powerful ERP system but requires technical expertise. Phocas has been supporting Netsuite customers with self-serve BI and FP&A solutions for many years. Perfecting an implementation process that's fast, fully supported and provides a single source of truth for all your data.

Make data analysis and running reports a breeze

“While NetSuite reporting is good, it isn’t always easy to generate and access interactive reports quickly. The ERP’s reports are often static, meaning it will show you one thing, and one thing only, whereas if we do it in Phocas, it’s very quick for us to twist and turn data.”

Terry Fagan, ICT Operations Manager, Hairhouse

Trusted by companies worldwide

The Phocas platform empowers over 3,000 businesses who make, move and sell products. 97% of customers stay with us year-on-year because our platform gives people confidence to run their businesses better.

- Asko

- Bayer

- Bupa

- Fuji Xerox

- Gazman

- Repco

- Sistema

- Thermofisher

- Hoyts

- KYB

- Husqvarna

- Johnstone Supply

- Karcher

- WD-40

- Yamaha

- Bunzl

Easy ad-hoc analysis

- Drill down into underlying transactions for further interrogation of performance

- Easily make side-by-side comparisons such as year-on-year variances

- Sparklines (mini charts) allow you to quickly see trends and spot anomalies

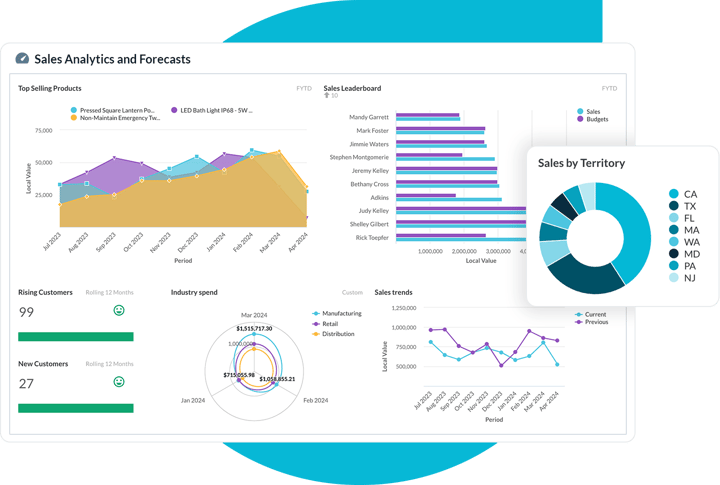

- View budget data in dashboards, to tell and explore your financial forecasting story.

#1 Reporting/Analysis & Predictive Planning

Insight software IDL vs Phocas

Anaplan vs Phocas

Board vs Phocas

Jedox vs Phocas

Visually presentable insights

- Build, customize and share unlimited dashboards and workflows, creating a clear business overview

- Visualize financial ratios and KPIs side-by-side, connecting different divisions, subsidiaries, branches to performance

- Quickly switch from visualizations to underlying data where you can slice and dice the metrics

- Present live data insights to non-finance teams using graphs, pie charts and Sparklines (mini charts) that are easy to understand.

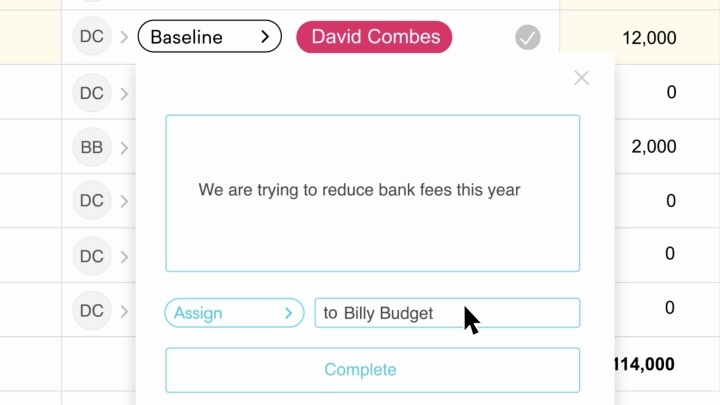

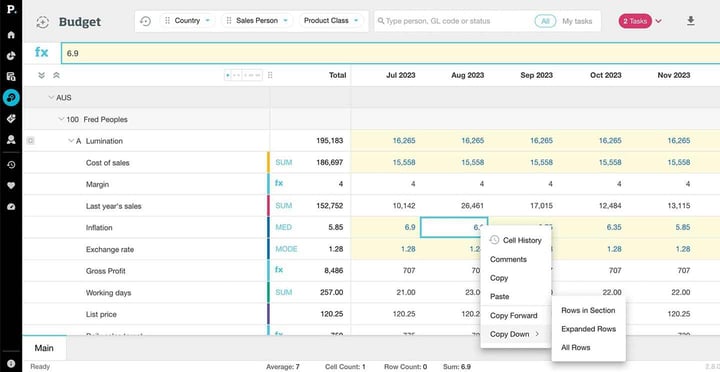

User-friendly forecasting

- An intuitive interface design offers a familiar format to Excel spreadsheets

- Swiftly navigate the budget worksheet, securely assign tasks, add commentary to cells, and gain full visibility of changes in real time

- Follow your train of thought and drill deeper to answer questions without the fear of breaking something

- The rate of user adoption is a direct reflection of ease of use - 97% of users recommend Phocas.

Customer quote

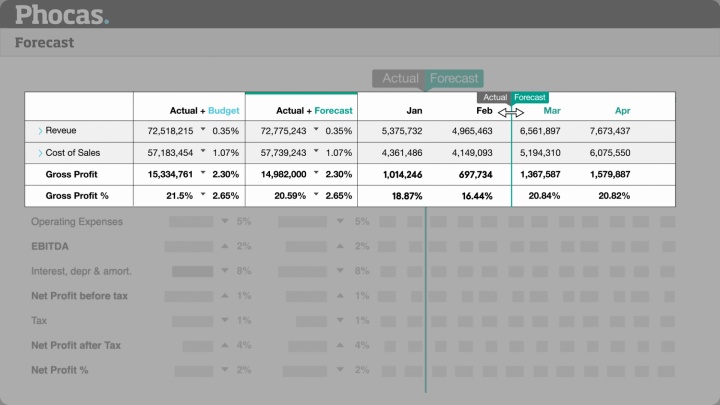

Compare budgets to actuals

- Budgets are only as good as the latest forecast. Compare actual performance to budget, highlight focus areas for improvement and create better re-forecasts.

- Turn your budgets into living, value-add tools for the whole business.

- Access financial data and reports, as well as sales and operational data to help you confidently build robust forecasts across the business.

- Assign security, share workflows across departments and make collaboration an intrinsic part of the process.

Operational & financial driven budgets

- Incorporating sales and operational data into your planning helps drive your budget.

- Balance workforce planning and inventory with changing business needs.

- Assess up-to-date performance data and create more accurate demand forecasts.

See Phocas Budgets and Forecasts in action

Phocas Budgets and Forecasts is a cloud-based planning tool that handles complex and detailed budgeting requirements while also being refreshingly easy to use.

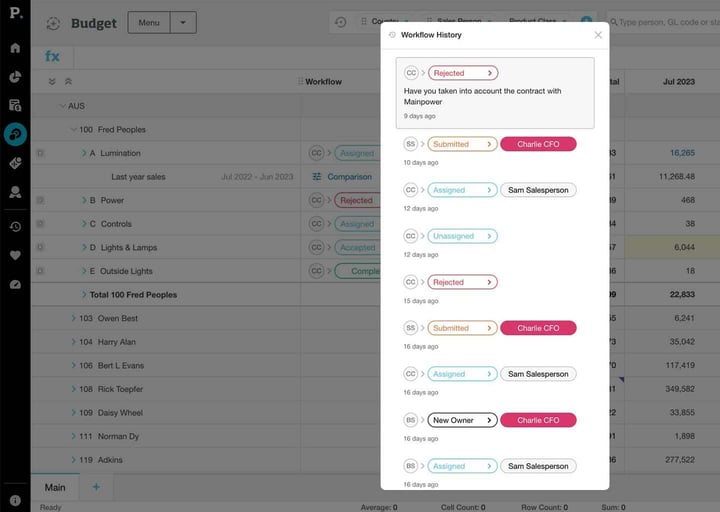

Real-time collaboration

- Access financial, sales and operational data from one trusted source of truth.

- An intuitive assignment, submission and approval process means everyone is accountable - no more chasing feedback.

- Built-in security means you'll only see what you're permitted to see and action.

- Budget changes are updated in real-time so version control issues are a thing of the past.

Customer quote

I love that you are able to assign category/accounts to individuals for review, to ensure each department has a say in the budgeting process."

Fast implementation, full support

Frequently asked questions

Financial consolidation with Netsuite is a critical but complex process for businesses with multiple subsidiaries or divisions. A third-party tool like Phocas can greatly simplify this process by offering enhanced capabilities and automation. Here's how Phocas can streamline each step of the Netsuite financial consolidation process:

Automated Data Aggregation: Phocas can automatically gather financial data from Netsuite and various sources, including different ERP systems used by subsidiaries, reducing manual data entry and the risk of errors.

Seamless Currency Conversion: With Phocas, currency conversion is handled efficiently, applying current exchange rates to convert subsidiary financials into the parent company's reporting currency, while also accounting for historical rates where necessary.

Standardized Adjustments: Phocas allows for the standardization of accounting policies across all entities, ensuring that financial data is consistent and comparable, which is crucial for accurate consolidation.

Consolidation-Specific Adjustments: Phocas facilitates the calculation of minority interests and other consolidation-specific adjustments, ensuring that the ownership interests are accurately reflected in the consolidated financials.

Dynamic Financial Reporting: Phocas enables the creation of dynamic, customizable financial reports that reflect the consolidated financial position and performance of the entire enterprise in real-time.

In-Depth Analysis and Review: The tool provides advanced analytics capabilities, allowing finance teams to drill down into the consolidated numbers for a thorough review and analysis.

Accessible Reporting for Stakeholders: Phocas makes it easy to share consolidated financial statements with stakeholders through user-friendly dashboards and automated distribution features.

By leveraging a third-party tool like Phocas, businesses can overcome the complexities of Netsuite financial consolidation. Phocas not only automates and simplifies each step of the process but also provides the clarity and insight needed for strategic decision-making. It empowers businesses to manage their financial consolidation more efficiently, freeing up valuable time and resources to focus on growth and performance.

When searching for the best financial consolidation software to complement NetSuite, it's important to focus on several key aspects that will ensure the tool enhances your financial processes and aligns with your business needs. Here are the essential features to look for:

Seamless NetSuite Integration: The software should integrate flawlessly with NetSuite, ensuring data integrity and minimizing the need for manual data transfers.

Multi-Currency Management: Given the global nature of many businesses, the tool must efficiently handle multiple currencies, including currency conversion, revaluation, and accounting for exchange rate fluctuations.

Real-Time Data Consolidation: The software should offer real-time or near-real-time consolidation capabilities, providing timely insights into the financial status of the entire enterprise.

Scalability: The consolidation software must be able to scale with your business, handling an increasing number of transactions and entities without performance degradation.

Drill-Down Capabilities: Users should be able to drill down into consolidated figures to view the underlying data and transactions for detailed analysis and transparency.

Flexible Reporting: The tool should offer flexible and customizable reporting options, allowing you to create consolidated reports that meet specific organizational requirements.

Audit Trails and Security: Strong audit trails and security features are essential for tracking changes, ensuring data security, and maintaining compliance with regulatory requirements.

User-Friendly Interface: A consolidation tool with an intuitive interface will facilitate wider adoption across the organization and reduce the learning curve for new users.

Collaboration Features: The software should support collaborative workflows, enabling different departments and subsidiaries to contribute to the consolidation process efficiently.

Performance Monitoring: The ability to monitor financial performance against various benchmarks and KPIs is important for strategic decision-making.

Support and Training: Adequate vendor support and comprehensive training resources are critical for successful implementation and ongoing use of the software.

Vendor Expertise and Reliability: Consider the provider's experience, customer support, and track record in financial consolidation to ensure you choose a reliable solution.

By prioritizing these features, you can select a financial consolidation software that not only complements NetSuite but also streamlines your consolidation process, enhances financial visibility, and supports informed decision-making across your organization.

Understand the past, operate better today, and plan well for the future