4 reasons why BI and FP&A tools improve financial reporting

How much time does your finance team spend collecting, analyzing, and sifting through data? According to a Deloitte report, finance teams spend nearly half their time on creating and updating reports. Operating at such a tactical level leaves little room for strategic analysis or effective planning.

With the increasing demands on finance teams, the ability to quickly analyze consolidated business data, uncover insights and efficiently present them to the business through financial reporting are absolute necessities.

In this blog we address why financial reporting software is now an essential tool for maintaining and enhancing the financial health of your businesses.

Auto consolidation

Finance teams have a huge responsibility in reporting on a company’s financial performance to leadership teams and other stakeholders. But it's not enough to present surface-level data. Teams need timely, accurate financial insights to help them make key business decisions, incorporating data that spans across the whole business; sales, operations, HR, marketing and beyond.

However, in most organizations, finance teams spend countless hours manually pulling data from ERPs and other sources, applying complex formulas, and creating static financial reports for cross-functional teams.

As financial data is kept siloed from operational data, contributors must return to the finance team for queries or clarifications, further delaying decision-making.

A modern BI and FP&A platform enables dynamic reporting, allowing teams to move away from static, error-prone Excel spreadsheets. These tools automatically consolidate real-time financial and operational data. This gives you clear visibility into the financial health of your business by breaking down data silos and encouraging cross-departmental input and accountability. With up-to-date, consolidated data at their fingertips, finance teams have more time and mental bandwidth available to dedicate to analyzing financial performance, tracking trends, mitigating risks, creating more accurate budgets and forecasts, and delivering faster insights that will drive smarter business decisions.

Self-serve, accurate financial reporting

When finance teams spend most of their time gathering and preparing data for reports, it leaves little opportunity to focus on high-value, strategic activities. A McKinsey study shows that finance leaders only spend 19% more time on strategic work than their peers—a small difference given their critical role. So how can you enable finance teams to focus on planning and analysis?

The answer lies in self-serve financial reporting. What if you could create and automate income statement, balance sheet and cashflow statements in minutes? Better still, what if other departments could build and customize their own reports, rather than relying on finance or IT? BI and FP&A tools make this possible as the foundational component required for reporting; the data, is already consolidated, up-to-date and easy to access. The finance team can focus its attention on more strategic practices, while the wider business is empowered to be more data-driven, productive and effective.

When financial reporting is this simple, it’s also much easier to dig into the data to really find out what's going on. Self-serve FP&A software enables users to drill down to transaction-level reporting data, allowing teams to quickly spot underperforming areas, understand underlying causes, and take corrective action. By removing the manual effort from reporting requirements, you can achieve more insightful analysis, allowing teams to move from reactive reporting to proactive business planning.

Financial information is secure

Empowering cross-functional teams with self-serve data access, reporting and analysis is fantastic. However, it’s equally important to protect confidential or sensitive information like payroll and HRIS data. Finance teams will also be mindful of securing the general ledger. While it’s beneficial to connect the wider business to financial performance, the finance team must maintain control over the level of detail each person can access.

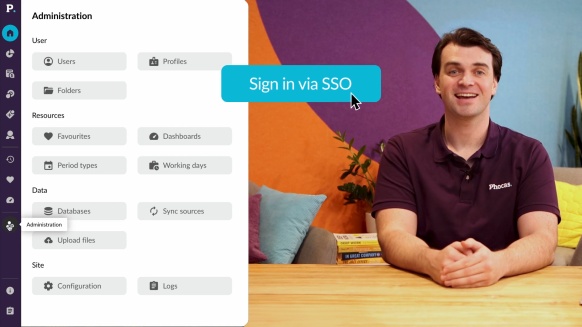

You can achieve the best of both worlds in terms of accessible data while maintaining security with a BI and FP&A platform like Phocas. This will provide you with a secure end-to-end solution that gives the finance team overall authority and enables them to set up individual user permissions. This allows you to customize data access according to each user. Once it’s set up, it also removes the administrative burden of constant permission adjustments. So, while teams outside the finance function are empowered to build their own reports and to freely drill into financial reports to better understand what’s going on, they will only be able to see and edit what they are permitted to.

Check out this quick demo video for more data security insights:

Financial statements are connected to planning

Having up-to-date financial statements that link to your budgets and forecasts will improve the accuracy of your planning and help you better manage the financial health of your business. BI and FP&A software automatically pulls real-time data from your ERPs and feeds it directly into income statements, balance sheets cashflow statements as well as your budgets and forecasts. As the software is self-serve, it is easy to regularly revisit the the budget throughout the fiscal year, compare actual financial performance to forecasts and then make adjustments to reflect current operational activities. This integration ensures that financial performance is always aligned with business goals, providing a clearer understanding of profitability, cash flow, and overall financial health.

Having this immediate insight into financial performance supports better planning, sharper decision-making, and ultimately, a more agile approach to managing growth and challenges. By linking financial statements to forecasts, companies are better equipped to respond to shifts in the market and to stay focused on long-term objectives.

The future of financial reporting: Phocas BI and FP&A

In today's business environment, the ability to create accurate, timely, and dynamic financial reports is essential for success. With Phocas’ integrated BI and FP&A platform, finance teams no longer have to waste valuable time on manual processes. Instead, they gain real-time, consolidated insights that allow them to focus on strategic initiatives. By breaking down data silos, providing self-serve reporting capabilities, and ensuring secure, customizable access, Phocas empowers businesses to streamline reporting and improve decision-making. The result? A more agile, informed, and financially healthy organization.

Empower your finance team with Phocas and unlock strategic value from your financial data.

Lindsay is an experienced writer with a passion for translating complex content into plain language. Specializing in the software industry, she explains the importance of data access and analysis for all businesspeople, not just the data experts.

Related blog posts

NetSuite is a powerful enterprise resource planning (ERP) system, but when it comes to reporting, many finance teams find themselves hitting a wall. Financial and operational reporting is essential for running a business, yet generating timely, accurate and specific reports from NetSuite often requires a heavy lift from finance teams and that’s just the beginning.

Read more

NetSuite, a powerful ERP, promises streamlined operations and robust financial management. Yet, for many businesses, the idea of quick, detailed financial reports often collides with the reality of technical configurations and reporting limitations. The very customization that makes NetSuite so adaptable can become a double-edged sword, leading to a frustrating maze of saved searches and data silos.

Read more

Managing project costs can often feel like an uphill battle. Unexpected expenses, budget overruns and lack of financial visibility are common issues that can derail even the most well-planned projects. These challenges not only cause stress but also jeopardize the project's success and client satisfaction.

Read more

It’s a common scenario: you’re out for dinner with friends, and you've enjoyed a nice meal. Now it’s time to split the bill.

Read moreBrowse by category

Get a demo

Get a demo Find out how our platform gives you the visibility you need to get more done.

Get your demo today