The key automotive KPIs and metrics to know and measure

Get your copyIn the automotive industry, an increase in competitors and challenges means companies must work smarter and faster.

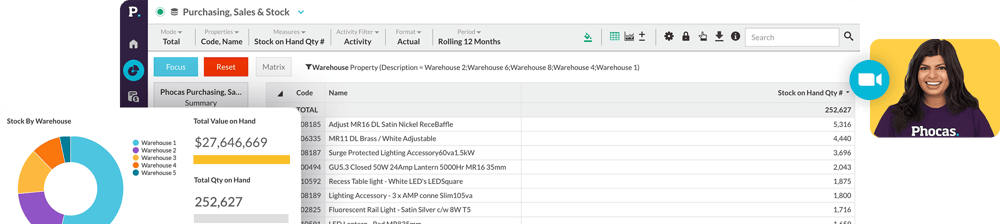

In this eBook, we discuss the key KPIs and metrics to measure in the automotive industry.

Unlock your free eBook

Understand the past, operate better today, and plan well for the future