Profit-driven rebate management

Know exactly where you stand, with Phocas - 3:15s

Automated rebate management

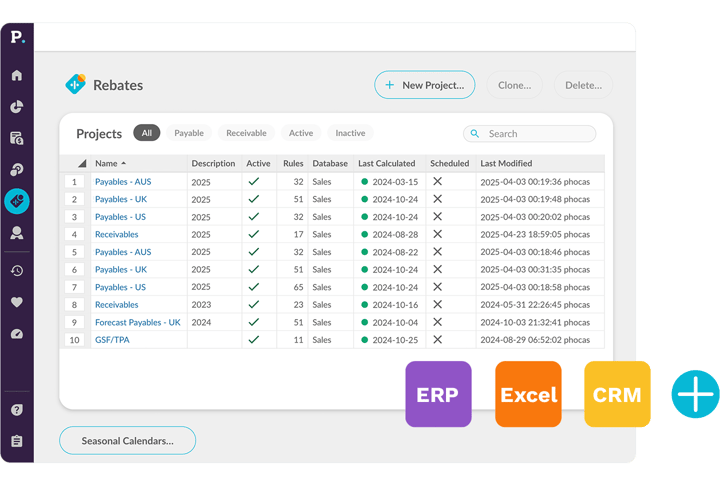

- Correct, first time: set it up rebate structures once, automate calculations, clone them for next year, and make easy adjustments.

- Efficient: rebate data updates automatically, ensuring teams have instant access anywhere, anytime

- Self-serve: easy-to-use software empowers more people to actively track and analyze rebates; sales, purchasing, finance, operations

- ERP compatible: fast integration – automatically pulls ERP data + any source into one platform

Maximize margins, incentivize sales

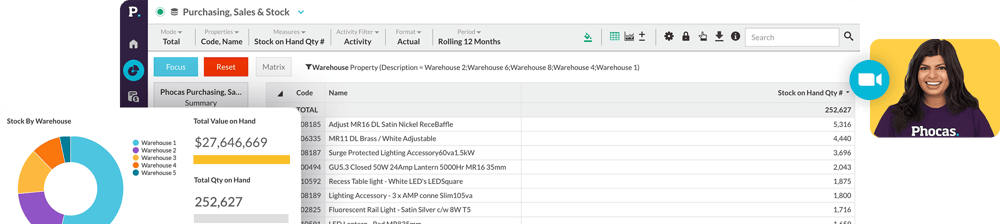

- Visibility: instantly see which products and vendors drive the most rebates

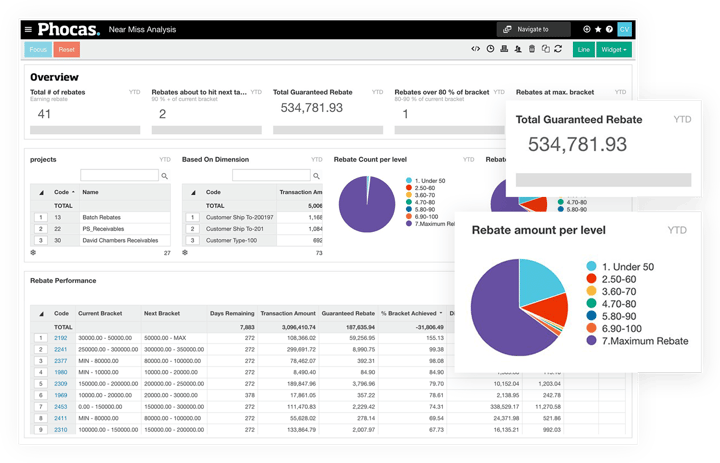

- Hit targets: use near-miss analysis to see exactly how close rebate targets are, adjust purchasing decisions before periods close

- Analyze: compare profit margins by customer, branch, product, supplier – before and after rebates

- Capitalize: track target accruals and explore 'what if' scenarios to uncover new earning opportunities

- Margin control: see true product costs after rebates to make better pricing and purchasing

Empower your sales team

"Before Phocas, we were less likely to use sales rebates as a tool as it was so cumbersome to provide information to the customer and track ourselves. Now our sales people know this is a tool they can use when selling."

Scott Sokoly

Business System Administrator at Trade Supply Group

Self-serve tracking

- Track: regularly review rebate programs including their structure, if they're driving sales, and view impact on profit and margin in one place

- 360º view: get a clear view of performance; profit and margin by customer, product and supplier before and after rebates

- Drill-down: analyze data by vendor, product line, or branch to spot risks such as product margin erosion

- Automate: create custom reports and dashboards in minutes, and set up alerts so you don't miss anything

Trusted by companies worldwide

The Phocas platform empowers over 3,000 businesses who make, move and sell products. 97% of customers stay with us year-on-year because our platform gives people confidence to run their businesses better.

- Asko

- Bayer

- Bupa

- Fuji Xerox

- Gazman

- Repco

- Sistema

- Thermofisher

- Hoyts

- KYB

- Husqvarna

- Johnstone Supply

- Karcher

- WD-40

- Yamaha

- Bunzl

Payable & receivable rebates

- Volume: Tiered rebate pricing that varies depending on order volume

- Growth: Paid on condition of targeted percentage in volume

- Retrospective: Reward and incentivize customers after/from a specific threshold. Can be applied to absolute or growth rules.

- Mix: Encourages the sale of larger product volumes with a higher profit margin

- Retention: Can be volume, growth, or mix - usually accrued over a specified time

- Percentage: Offered as a percentage of total revenue such as a rate of 2%

- Multi-bracket: Calculate all rebate rules across a range of brackets and dimensions

Phocas customers reaping the rewards

Weekly admin hours saved

$s processed/month

Rebates rules managed

Fast implementation, full support

Frequently asked questions

Rebate management is the process of administering and overseeing rebate programs. Many businesses manage multiple rebates programs simultaneously, from simple to complex.

Rebate management software, solutions that help manage this complexity with ease are a common way for businesses to get the most out of supplier and customer rebate programs.

Retailers and distributors benefit from rebates software irrespective of their payable or receivable arrangements. For retailers, it streamlines the claims process, ensuring accurate and timely receipt of rebates from manufacturers or suppliers. For distributors, the software automates payable rebates, ensuring precise calculations and timely payouts. It fosters stronger partnerships and incentivizes distributors to support the business's initiatives more effectively.

By seamlessly integrating with ERP systems, CRM platforms and other source data, APIs ensure real-time data synchronization for vendor and customer rebate agreements, enabling accurate calculations and validations. This integration streamlines both payable and receivable rebate processes, reducing manual data entry and potential errors. Moreover, APIs allow businesses to leverage third-party tools and data sources, enriching the rebate management system with additional functionalities and insights.

Rebate software helps identify and prevent revenue leakage by automating the entire process. For payable rebates, it ensures that calculations are accurate, and payments to channel partners and distributors are timely, reducing the risk of overpayments and discrepancies. For receivable rebates, the software validates claims against predefined terms and conditions, minimizing instances of revenue leakage caused by inefficient manual processing. By providing detailed analytics and reports, businesses can proactively address potential issues, optimizing both payable and receivable rebate programs to safeguard their revenue and profitability.

Understand the past, operate better today, and plan well for the future