Customized financial reports for quick analysis

Quick, obligation free

See how Phocas streamlines financial reporting - 1:17s

See your financial health at a glance

- Create income statement, balance sheet and cashflow statements for all divisions in a few clicks

- Take advantage of formulas and custom metrics for margins and KPIs to display in reporting

- Statements update automatically with the latest data

- Empower the whole business with relevant financial information, customized for their needs instantly

Empower your finance team

"This is a very user-friendly product. We can build it and compare numbers month over month, or year over year. And it's very helpful to build in some of those gross margin and some of those analyticals into the financial package that we use at month end as well as every day."

Amanda Ware

Director of Accounting and HR at Stokes Electric Company

Financial Statements in action: Take a video tour

-

Automate month-end

Speed up month-end close by 50%. See how Phocas automatically structures your data into up-to-date financial statements, saving you hours of number-crunching. -

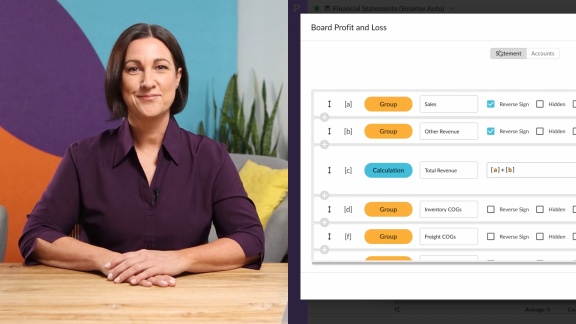

Customize statements

Phocas makes customization a breeze. Learn how users can easily tailor statement views to suit specific needs without the hassle of spreadsheets. -

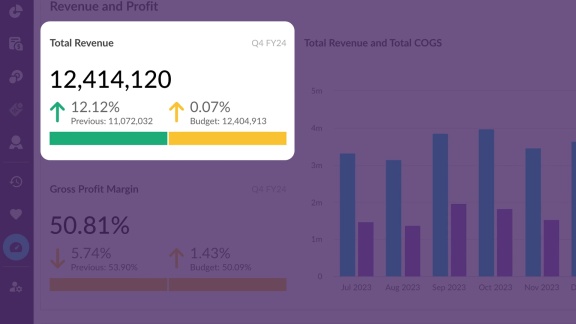

Track performance

With Phocas, dynamic, interactive statements and dashboards allow you to track performance at any time and to freely investigate your financials. -

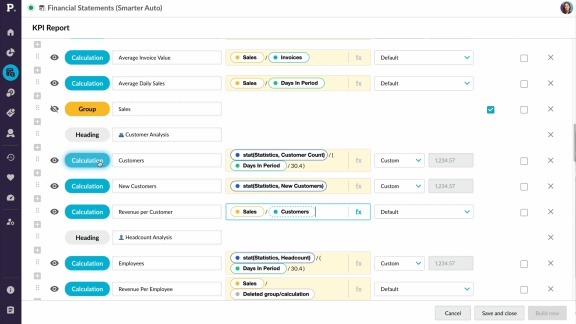

Financial ratios

Phocas simplifies the process of creating and tracking essential financial ratios. In this video, learn how to build custom ratios, like revenue per customer, to keep your business on top of its key performance metrics. -

Spot opportunities & risks

With Phocas, you can easily check for errors, spot potential risks and uncover the root causes very quickly by drilling down to the transactional data. -

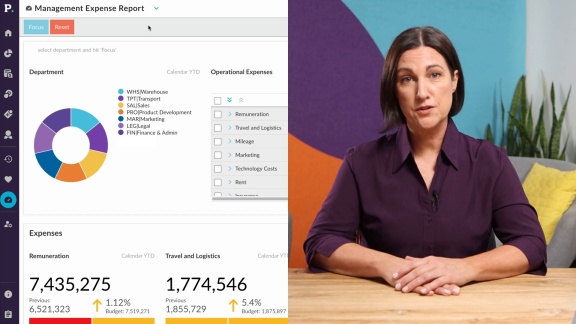

Management reporting

Phocas makes it easy to create tailored, up-to-date management reports and board-level dashboards. Customize views for each department, and share insights effortlessly, all from one platform. -

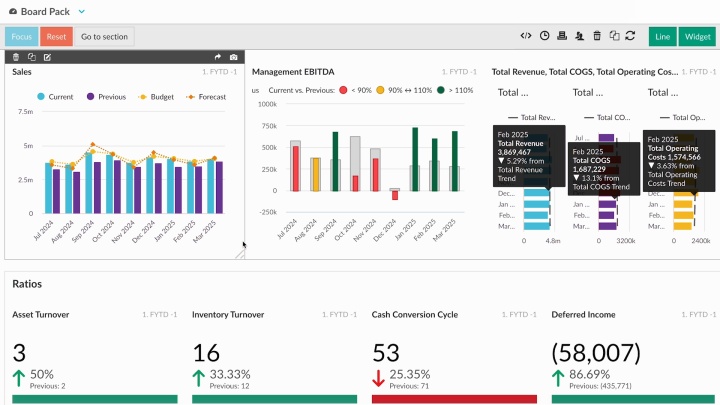

Visual storytelling

See how Phocas brings performance metrics to life with dashboards and charts, making it easier for non-financial team members to engage with their numbers. -

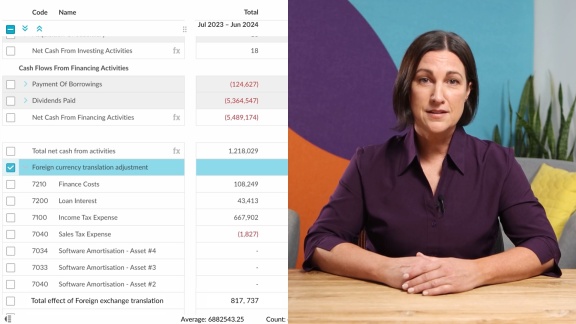

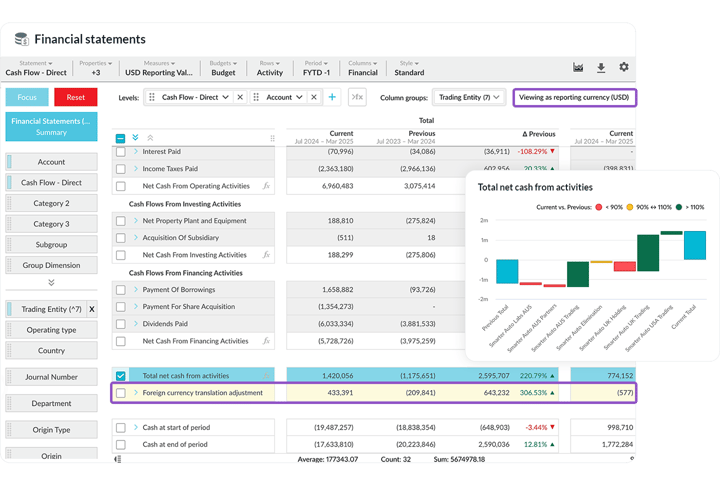

Financial consolidation

Phocas makes it easy to report across multiple currencies and subsidiaries in your Profit and Loss, balance sheet and cashflow statements.

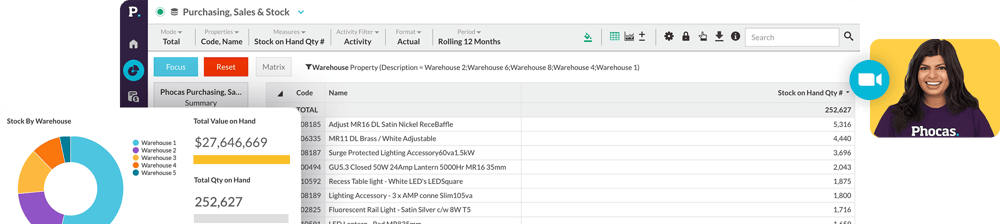

More insight into your business performance

- See underperforming areas by tracking live actuals against budgets

- Analyze revenue and expenses with side-by-side comparisons

- Filter analysis for group, subsidiary, branch, brand or product views

- Create and track specific business-related ratios by pairing operational and financial data

Phocas can manage a lot of data, so in seconds, I have up-to-date financial reports.

Epicor + Phocas customer

Find the outliers in your financials quickly

- Understand what's changing and why with variance analysis

- Have more time to analyze cashflow or operations

-

Built-in data checks ensures accurate ongoing updates

-

Share information and ideas across different parts of your business

Kerridge + Phocas customer

Management reports to suit your business

- Customize reports for branches, divisions, board with various reporting levels

- Control security access without touching the general ledger

- Provide teams with self-serve dashboards for ad hoc review from anywhere

- See real-time performance across all your KPIs

Interactive visualizations

Make interpreting numbers easier so you can act faster.

- Build, customize and share dashboards for a clear business overview

- Understand the impact of financial ratios and KPIs on performance

- Switch from visualization to underlying data across all metrics

- Impactful charts and graph options make performance easier to understand

Automate financial consolidation

- Automatic data integration from your entities or departments into a central database

- Generate consolidated balance sheets, income statements, and statements of cash flows

- Toggle between local currency and reporting currency

- Automatically calculate currency gains or losses from foreign subsidiaries in the balance sheet and cash flow

Phocas supports cross-functional departments. It’s cloud-based and can easily compare multiple groups of data.

Infor + Phocas customer

See how Phocas stacks up

Anaplan vs Phocas

Board vs Phocas

Jedox vs Phocas

Oracle Cloud EPM vs Phocas

Prophix vs Phocas

Vena vs Phocas

Frequently asked questions

Financial statement software is designed to help finance teams prepare multiple financial statements and management reports instantly. It automates the process of creating financial statements by pulling data from ERP, CRM and multiple other data sources. The consolidated data ensures accuracy, consistency and compliance with accounting standards.

Some financial statement software also includes advanced features such as analysis tools, connection to budgeting and forecasting capabilities and customizable templates.

There are several benefits of using Financial Statement software over Excel or other manual reporting methods:

-

Time-saving: It frees up the finance team from manual reporting and data management by automating the entire process, allowing for faster reporting, consolidation and customization.

-

Accuracy: Data is pulled directly into the software which reduces the risk of errors that can occur when maintaining and reworking static spreadsheets.

-

Standardization: enforces standardization across financial statements to ensure consistency in reporting and enables comparisons across different periods.

-

Collaboration: enables teams to collaborate and work simultaneously in a secure and audit-friendly environment. This can improve communication and reduce the risk of data discrepancies.

-

Reporting: provides advanced reporting capabilities, such as customizable templates and interactive dashboards. Easier to visualize data and identify patterns and trends.

-

Security: It provides better security features than Excel, including data encryption, user access controls, and audit trails. This can help protect sensitive financial data from unauthorized access or modification.

- Customizable: You can add calculations to the statements such as EBIT, margins and ratios

While Excel can be a useful financial tool, Financial Statement software can help businesses streamline financial reporting processes, improve accuracy, and make better, faster decisions based on real-time data.

The three common financial statements are:

-

Balance sheet: This statement provides a summary of a company's financial position at a particular point in time. It shows the assets, liabilities, and equity of the company.

-

Income statement: Also known as a profit and loss statement, this statement shows a company's income and expenses over a period of time. It provides information on the company's profitability and financial health.

-

Cash flow statement: This statement shows the inflows and outflows of cash for a company over a period of time. It provides information on the company's ability to generate cash and its liquidity position.

Yes, financial statements are a key component of financial analysis. They provide essential financial data used to assess a company's financial health, performance and potential for future growth.

Financial statements are used to evaluate a company's liquidity, profitability, solvency, and stability to develop a complete picture of a company’s financial profile.

Business people use financial statements to assess the company's performance against industry standards, identify trends and patterns, evaluate the company's strengths and weaknesses, and forecast future performance.

Financial statements are also used by investors, lenders, and other stakeholders to make decisions about investing or lending to the company. They are an essential component of financial analysis and play a crucial role in the decision-making processes.

Choosing the best financial statement software for your business depends on your specific needs, budget, and the features of the software. Here are some key features to consider when evaluating financial statements software:

-

Customizable statements and reports: Custom reporting allows you to create and automate reports specific to the nuances of your business.

-

Automatic data entry and reconciliation: Software that automatically imports and reconciles financial data from multiple sources can save you time and reduce errors.

-

User-friendly data visualization tools: Highly visualized, interactive, and customizable dashboard features allow you to quickly analyze and present financial data to stakeholders.

-

Budgeting and forecasting tools: Software that includes budgeting and forecasting functionality can help you plan and predict future financial performance to make informed business decisions.

-

Integration with other ERP or financial management tools: Look for software that integrates with your ERP or financial management tools (such as accounting software, payroll software, or tax software) so you can streamline your financial management processes.

-

Security and compliance features: Robust security and compliance features (such as data encryption, access controls, and audit logs) help protect your financial data and comply with industry regulations.

When evaluating software options, prioritize the features that are most important to your business needs, and choose software that offers the best combination of features, usability, and affordability.

Analytics is used in finance to help businesses make informed decisions . Here are some ways analytics is used in finance:

-

Risk management: Analytics can be used to identify and mitigate financial risks. By analyzing historical data and market trends, businesses can identify potential risks and take steps to minimize them.

-

Financial forecasting: Analytics can be used to forecast financial outcomes based on historical data and other variables. This can help businesses to better plan for the future.

-

Performance analysis: Analytics can be used to track and analyze financial performance metrics such as revenue, profitability, and return on investment. This helps businesses identify areas of underperformance and take corrective action.

-

Cost analysis: Analytics can be used to analyze and optimize costs in financial processes such as procurement, inventory and supply chain management. This helps businesses reduce costs and improve efficiency.

Analytics is becoming an increasingly important tool in finance, helping businesses to gain insights, make better decisions, and manage risks more effectively.

Understand the past, operate better today, and plan well for the future