The importance of effective cash flow management

Cash flow is vital for businesses. It is the money coming in and going out of a business. It’s like fuel for a car. Without enough fuel, a car can't move forward; similarly, without enough money, a business can't operate or grow effectively.

Think of it as the ebb and flow of cash that keeps the business running smoothly. Cash comes in from sales, or investments and the cash flows out for expenses, purchases, payroll and other overheads. A company’s cash is vital for business continuity, encompassing legal and other obligations that necessitate prudent management of cash flow.

In this blog, we'll deep dive into why mastering cash flow management is critical for businesses, and how leveraging tools like three-way forecasting, particularly with Phocas's innovative mini-drivers, can empower business leaders.

Advantages of positive cash flow

Positive cash flow is when you make more money than you then you spend. Maintaining healthy cash flow ensures that a business has enough liquid assets to meet its short-term obligations, such as payroll, rent, and supplier payments. This liquidity is essential for the day-to-day operations and overall solvency of the business.

Efficient cash flow management allows a business to optimize its working capital. By minimizing the time between receiving revenue and paying expenses, a company can improve its operational efficiency and reduce the need for external financing.

Financial stability

Prudent cash flow management contributes to the financial stability of a business. It helps cushion the impact of unexpected expenses or revenue fluctuations, reducing the risk of insolvency or financial distress.

Increased opportunities for growth

Positive cash flow provides opportunities for investment in growth initiatives, such as expanding operations, launching new products, research and development, or other investing activities. Prudent cash management ensures that funds are available for these strategic investments when opportunities arise.

Good credit rating

Effective cash flow management ensures that business owners can meet their debt obligations, including interest payments and principal repayments. This helps maintain a good credit rating and access to financing on favorable terms.

Preparation

A business with enough cash is better equipped to adapt to changing market conditions, economic downturns, or unforeseen challenges. It provides the flexibility to weather periods of uncertainty and position the company for long-term success. If the last few years have taught us anything it is to be prepared for unexpected events. The pandemic, bushfires, floods, and geo-political conflicts have led to supply chain shortages and subsequent inflation, presenting unforeseen challenges.

Consequences of negative cash flow

Negative cash flow is the opposite of positive cash flow. When a company experiences negative cash flow, it means that more money is flowing out of the business than is coming in. Negative cash flow can have significant impacts on businesses, affecting their operations, growth prospects, and overall financial health. Here are some key impacts:

Financial strain

Negative cash flow puts a strain on a company's finances and business owners’ state of mind. It can lead to difficulties in meeting day-to-day expenses such as salaries, rent, utilities, and supplier payments. This strain can escalate if the situation persists, potentially leading to insolvency if not addressed promptly.

Limited growth opportunities

Without enough money, a company's ability to invest in growth opportunities is hampered. Insufficient funds can strain business operations, limiting investments in research, development, or strategic initiatives. This constraint may impede competitiveness and long-term sustainability.

Increased borrowing and interest costs

To cover operating expenses during periods of negative cash flow, businesses may resort to borrowing. However, increased borrowing comes with additional interest costs, further exacerbating financial strain and reducing profitability. Moreover, relying heavily on debt to finance operations can increase financial risk.

Impact on credit rating

Consistently negative cash flow can harm a company's credit rating. Lenders and creditors assess cash flow stability when extending credit or loans. A poor cash flow position may result in higher interest rates, stricter borrowing terms, or even credit denial, limiting access to essential financial resources.

Employee morale and retention

Financial instability caused by negative cash flow can affect employee morale and job security. Uncertainty about the company's future viability may lead to increased stress and anxiety among employees. Additionally, the challenge of offering competitive salaries and benefits can significantly affect both employee retention and recruitment endeavors.

Strained supplier and vendor relationships

Difficulty in making timely payments to suppliers and vendors due to negative cash flow can strain relationships. Suppliers may become reluctant to extend credit or offer favorable terms, potentially disrupting the supply chain and affecting product quality and delivery schedules.

Cash flow in a distribution business

Within Distribution businesses, where products are created, moved, and sold, effective cash flow management stands as a cornerstone for success. They operate in a dynamic environment where factors like inventory management, accounts receivable, and payable cycles play pivotal roles in financial health.

In this environment, maintaining optimal levels of inventory, ensuring timely collection of receivables, and managing account payables efficiently are key determinants of success. However, achieving this balance requires more than just a keen eye; it demands effective cash flow management, and financial planning software tools that meet the challenge.

For distribution businesses, maintaining the right amount of net cash on hand at any given time is paramount to ensure smooth operations and the ability to capitalize on growth opportunities. A prudent approach involves striking a balance between liquidity and investment in inventory and infrastructure. Having adequate net cash reserves enables distribution businesses to cover day-to-day operating expenses, manage fluctuations in demand, and respond swiftly to unexpected challenges or opportunities in the market. However, tying up an excessive amount of cash in idle balances can hinder profitability and hinder the ability to invest in strategic initiatives.

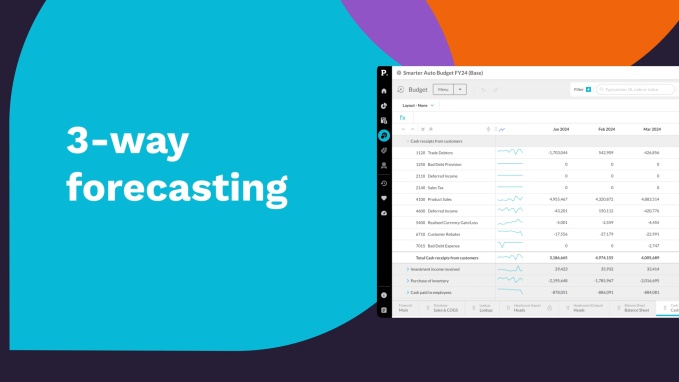

Three way cash flow forecasting

Three-way forecasting and modeling takes into account the three primary financial statements: the income statement, balance sheet, and cash flow statement. Whenever adjustments are applied to the balance sheet or profit and loss statements, they seamlessly transfer to the cash flow statement. This ensures a precise reflection of your company’s financial standing and illuminates how specific choices influence cash flow.

Let's take a moment to review the primary types of financial statements for a quick refresher. The income statement provides insights into revenue generation and expenses incurred over a specific period, offering a snapshot of profitability. The balance sheet, on the other hand, presents a snapshot of the company's financial position at a given point in time, showcasing assets, current liabilities, and equity. Finally, the cash flow statement tracks the amount of cash into and out of the business, capturing operating, investing, and financing activities.

By integrating these three statements, businesses can uncover deeper connections and dependencies within their business. This integrated perspective enables more accurate forecasting. This becomes particularly invaluable for businesses like wholesale distributors, where the interplay between sales, inventory, and receivables is intricate.

The three-way model enables business leaders to address various questions such as:

- What impact will a new product line have on my bottom line?

- Will the business have the number of staff and capital to retool to manufacture it?

- How do different accounts payable and receivable terms impact cash flow for the new product or existing products?

Distribution businesses today face a multitude of challenges, from supply chain disruptions to shifting market demands. Navigating these complexities requires foresight into how these challenges will reverberate through cash flow in the short, medium, and long term.

Imagine a distribution company based in Australia specializing in organic food products. It’s a mid-size business looking to grow. Despite robust demand, the company grapples with persistent hurdles such as logistical bottlenecks, rising transportation costs, and fluctuating exchange rates.

Amidst the day-to-day operational hustle, the company's leadership recognizes the imperative of addressing broader strategic concerns promptly. Among these, a pressing priority is to optimize warehouse operations and invest in advanced inventory management systems to streamline processes, adapt to evolving customer preferences, and expand their distribution network.

With many variables at play, determining where to focus efforts becomes a daunting task. However, leveraging a tailored three-statement financial model empowers the company to visualize how operational and financial adjustments will shape the bigger picture, guiding strategic direction.

This sophisticated model enables key stakeholders to ask critical questions such as:

- How will expanding the distribution network and adopting automated inventory tracking impact profitability over the next six and twelve months?

- What are the implications for cash flow if seasonal fluctuations in demand lead to inventory surpluses or shortages?

- Can the business sustainably manage increased overhead costs associated with technological upgrades while ensuring enough money for ongoing operations?

- How do alterations in payment terms with suppliers and customers influence cash flow dynamics?

Armed with precise insights derived from the model, the company's leadership gains the confidence to chart a course forward amidst uncertainty.

Effective business decision-making hinges on holistic understanding. Leveraging software that facilitates the construction of a robust financial model integrating the income statement, balance sheet, and cash flow statement streamlines this process. Any adjustments made in one facet automatically ripple through the others, ensuring ongoing analyses remain accurate and actionable.

Leveraging Phocas's mini-drivers

In Phocas's three-way forecasting model, the mini-driver is a specific metric or parameter that directly influences cash inflows and cash outflows within a distribution business. Not be confused with the mini-driver in golf or Minnie Driver, the British-American actress. Mini-drivers allow CFOs to fine-tune their forecasts and gain deeper insights into the factors driving their financial performance.

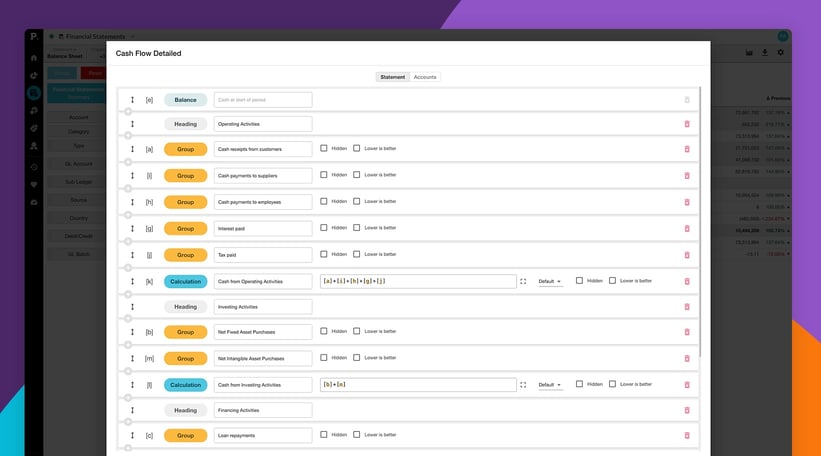

You can make various adjustments to your balance sheet with three ready-to-use templates for debtors, creditors, and stock. These templates come with pre-built lines and basic inputs for easy calculations. You can quickly model common interactions between your Profit and Loss (Income Statements) and Balance Sheet items without the hassle of manual formula entry.

You can also create a custom mini-driver, tailored to your specific needs and preferences. By utilizing these inbuilt drivers, businesses can fine-tune their three-way forecasting and gain actionable insights into their cash flow dynamics.

When considering using custom mini-drivers for your distribution business, prioritize platforms that seamlessly integrate your consolidated data, budgets, and month-end statements. Opt for solutions built on robust data platforms that ensure connectivity across your ERP, CRM, e-commerce, and inventory systems. This integration enables you to harness the power of real-time sales, operational, and financial data, providing a comprehensive view of your business operations in one centralized location. With the ability to access daily or even hourly updates, you can make informed decisions swiftly and adapt to changing market conditions with agility.

In essence, three-way forecasting moves beyond traditional cash flow forecasting methods by providing a panoramic view of financial performance

Overall, prudent financial management and cash flow management are essential for the financial health, stability, and growth of a business. It allows companies to maintain liquidity, operate efficiently, and seize opportunities for investment and expansion while mitigating risks and ensuring financial stability.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

Related blog posts

Asahi Group (a large beverage manufacturer and distributor) recently experienced a cyberattack that didn’t destroy the business, but did create the kind of operational and financial mess most mid-market companies recognize. Orders couldn’t be processed normally, shipments were delayed, call centres were disrupted and some products became temporarily hard to get in retail and hospitality channels. The impact showed up quickly in results. Domestic sales dropped materially for a period while systems were restored and workarounds were put in place.

Read more

Financial planning and analysis (FP&A) provides the insights that drive growth, protect profitability and guide new investments. Done well, FP&A transforms raw financial data into scenario models and forecasts, helping finance leaders and business units move ahead with confidence.

Read more

If the owner of your business wants to expand to a new State, would you have the sales forecasting figures to know whether the business can afford to do that or not? Or, if you had to produce a 3–year solvency projection for the CEO, is your sales forecasting process robust enough to support a reliable analysis?

Read more

NetSuite is a powerful enterprise resource planning (ERP) system, but when it comes to reporting, many finance teams find themselves hitting a wall. Financial and operational reporting is essential for running a business, yet generating timely, accurate and specific reports from NetSuite often requires a heavy lift from finance teams and that’s just the beginning.

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today