Collaborative FP&A – a Q+A session to understand how it works

The kind of analysis FP&A teams provide has long been about financial data. Business leaders and finance leaders are now interested in performing this type of rigorous planning across the whole company and incorporating all data, from sales to operations. This shift has come in part due to global economic uncertainty and because businesses need the full picture to make real-time decisions and perform truly robust financial planning.

Accountants, CFOs and finance teams are turning to FP&A software to perform data consolidation and automate common processes – so that the planning, budgeting and analysis — is accurate, companywide and collaborative.

In this blog, we host a Q&A session with Phil Dodds, Executive Director of Phocas, trained CPA and software entrepreneur in which we discuss all things collaborative FP&A. Phil covers what it is, the biggest challenges facing finance teams right now and how the right FP&A software can help in overcoming these challenges to facilitate the shift from traditional financial planning towards collaborative planning.

Question: Phil, in your experience of collaborative FP&A, what are the key learnings for finance professionals wanting to move into a trusted advisor role?

Answer: Firstly, it’s great we are talking about collaborative FP&A. The economy is still turbulent which is tough on most mid-market businesses. Many companies are particularly having trouble with cash flow as local and global markets remain unstable.

So, with that context in mind — the standard operational planning and sales planning that most businesses do is simply not enough anymore. This has two implications. The first is all departments need to reach out to the accounting professionals in the business to provide financial insights around the budgeting and financial planning process (which all takes time) and the second, CFOs and finance teams need to step up as trusted advisors.

In my experience, collaboration is the key behavioural shift in moving a finance leader or accountant from crunching numbers to becoming a trusted advisor. Budgeting, forecasting, and planning processes can be complicated but if you can do them collaboratively, then you're going to improve the results for your business and make better decisions.

However, a word of caution. Data consolidation (or rather, the inability to) is by far the biggest barrier to being able to perform collaborative FP&A. Your business will really struggle to be more collaborative, unless it has got good tools and systems to assist with bringing together all its ERP and other system data so that everyone has access to a single source of truth.

Question: In your own words, how would you explain what collaborative FP&A is to non-financial people?

Sure. So collaborative FP&A, or Financial Planning and Analysis, is all about teamwork within a company to plan and understand finances better. Instead of finance making all the decisions, it has the data and tools to seek input from operations, sales, and marketing to build budget models and align with their strategies.

Some of the key elements of collaborative FP&A are:

- Cross-functional collaboration: FP&A teams work closely with other departments to gather relevant data, insights, and assumptions for financial planning and analysis. This helps to ensure your financial plans make sense and help you to reach your goals.

- Shared data and information: All stakeholders need access to the same data and information, ensuring consistency and transparency across the organization. This helps to facilitate real-time decision making as everyone is on the same page and can trust the numbers.

- Iterative process: FP&A is by nature iterative, with continuous feedback and revisions based on profitability, changing business conditions, market dynamics and strategic priorities. Put simply, it's not a one-time thing; you have to keep working together, sharing ideas and making improvements as you go along.

- Scenario planning: Collaborative FP&A allows you to test out various scenarios and what-if analyses to assess the impact of different decisions and market conditions on the organization's financial performance. You can never account for every eventuality, but financial scenario planning is the next best thing.

- Alignment of goals: By involving stakeholders from different functional areas, collaborative FP&A helps align financial goals with operational and strategic objectives, ensuring your financial plans match up with what each part of the company is trying to achieve. Using a sporting analogy, it makes sure everyone in your business is rowing in the same direction!

Essentially, collaborative FP&A is about bringing people together, making smarter plans, improving strategic decision making and ensuring everyone in your business is working towards a common goal. I’m a huge advocate of the approach, and have witnessed first-hand how it can completely transform the way a business operates, for the better, when it’s positively embraced.

Question: Do you see the pressure of budgeting adding errors to this new style of collaborative FP&A? If so, how?

Answer: Absolutely. I mean, everybody knows the stress that can come with budgeting and the effect that has on an individual’s performance. Whether you budget monthly or annually, the stress is always there.

With so many moving parts to manage, what happens is the end task becomes focused on meeting the deadline, rather than achieving the right result with great accuracy. There's an entire process going on; your spreadsheets are sent out, they’re collated, consolidated and discussed. Then pushed back. It’s a never-ending, manual cycle which is prone to errors. People start overriding spreadsheets and accepting numbers without question, and effectively, the collaboration is neglected just to get the job done.

We also know that industry research backs up this lived experience.

According to a 2024 Gartner survey shared by Future CFO, “18% of accountants make financial errors at least daily, and a third commit at least a few financial errors every week. Further, 59% were revealed to have been making several errors per month”. Just imagine the potential impact these errors could be having on your organization?

Interestingly, the survey also reported that “companies that digitise with high technology acceptance for their technology environments see a 75% reduction in financial errors”.

Question: Does having multiple people involved in the FP&A process add complexity? Are there natural tensions due to different objectives?

Answer: Although interconnected, of course every team in a business has different objectives.

It’s the responsibility of sales managers to increase sales through discounts and promotions, while the production manager or the supply chain manager may be dealing with capacity constraints, for example, due to raw material shortages or with how many products they can physically manufacture and deliver.

So, FP&A tasks are not constrained to finance, but are widespread and vary across the organization. Whether you have a dedicated FP&A team or FP&A responsibilities are absorbed into your wider finance team, the finance function needs to be supportive of the objectives of each department while ensuring the process remains coherent and consolidated. It needs to be in tune with market conditions and external constraints. To predict the future and perform scenario planning at its best, you need to get the collaboration right and be agile across all departments.

For example, if sales has a massive forecast to reach, the FP&A team needs to circle back to production and find out whether the longer lead times for materials means the business can actually produce what it is planning to sell. So, the collaboration part needs to put “sales targets and production restraints” back into the model, re-run the model and then it’s a reiterative process from there until everyone agrees.

Question: Has global economic uncertainty added more urgency and complexity to the budgeting process?

Answer: Yes, I believe so. Most organizations have found that their budgeting models are outdated and are scrambling to manage cash flow due to constant price hikes in raw materials and energy. Historic business data may also be skewed because of unprecedented fluctuations in sales and costs during the years following the pandemic, making it more difficult for them to do incremental budgeting (which is arguably the easiest budgeting approach) and requiring businesses to be much more thorough.

The working environment has also changed. Traditional budgets are built in silos, owned by each department but now more finance teams are working from home than in the office, so collaboration has became more laborious and difficult. Real-time decision-making is near impossible when everyone isn’t in the same room and when the information underpinning it is spread across multiple, disparate systems.

For example, one of the hardest FP&A tasks to do remotely using traditional methods is forecasting. And this is backed up by data. According to the 2023 FP&A Trends survey, “forecasting processes are taking more time. Only 17% of organizations can produce a forecast in less than 2 business days (compared to 21% in 2022). The majority of organizations, 51%, take 5 days or more to complete a forecast.”

In response, we’re seeing more businesses investing in cloud-based FP&A platforms than ever before, with the survey also reporting that when “looking at future FP&A priorities, the highest priority is to enhance planning and forecasting by moving to a modern planning platform.”

Thanks to digital transformation and modern FP&A technology, CFOs and finance leaders will be more adaptable to ever-changing market conditions. They’ll have the power to make strategic business decisions based on data and insights, transforming their role in the organization from “number crunchers” to advisors. That’s the big shift CFOs need to make, but in a collaborative way.

Question: What should a CFO look for in a cloud-based FP&A tool?

Answer: I appreciate there are a lot of collaborative FP&A tools on the market and can imagine that it’s somewhat of a minefield for CFOs and finance leaders to determine where best to put their technology investment!

Here are some of the attributes of cloud-based online FP&A tools that our customers here at Phocas are finding appealing as they move to a new model:

- Automation of repetitive finance tasks

- Fast and easy to use, for everyone, regardless of their financial capabilities

- Allows for multiple users to be working on the same model in a secure way

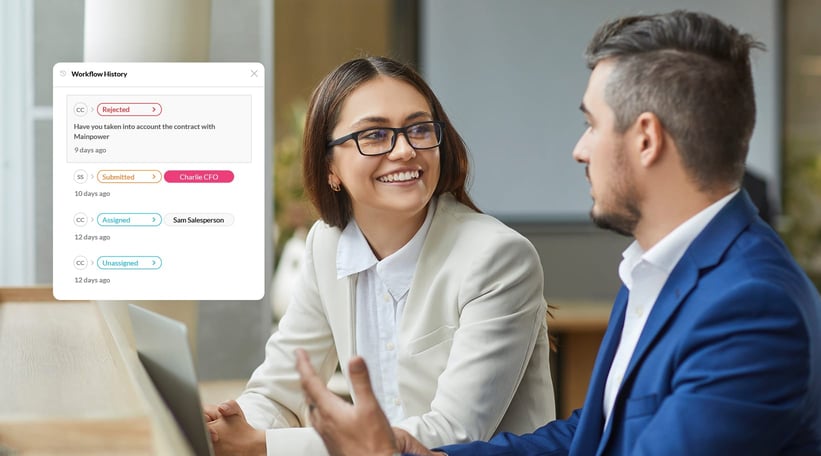

- Intuitive workflows to build new models and scenarios

- Fast recalculations

- Integrated to existing business intelligence tools for quick dissemination

- Visually appealing for better communications with stakeholders, including dashboards

- Future-focused, with built-in artificial intelligence and machine learning capabilities

Personally, ease of use is one of the most important criteria on that list. For example, when used together as a financial planning platform, Phocas Financial Statements and Phocas Budgets & Forecasts can really help to accelerate your journey towards collaborative FP&A because they are so easy to use that even non-financial audiences can use them. The result? More company-wide collaboration on the numbers.

Question: What is your advice to build the right culture in an organization to achieve collaborative FP&A?

Answer: For me, it’s all about the people. Whilst cloud-based software is the enabler, think less about the tools and more about the people who need to make the cultural shift and start using them. To build strong relationships across departments, CFOs need to work in partnership with people to establish trust and knowledge, and not work in isolation.

To do it well, seek out these partnerships by anticipating each business leader’s needs, and forget about your need to get the budget done. What are their cycles? When do they begin to budget? When would be a good time for them to help you re-assess and pivot if needed? It’s a two-way street. Be consistent and over-deliver by offering consistency and frequency with reports and dashboards, meet regularly and provide self-service capabilities for business leaders to monitor progress - so they don’t have to rely on the finance team to run reports for them. This in itself frees up finance teams from simply reacting to business reporting requests to proactively working on more value-add FP&A tasks.

I also recommend changing the perception of being a “number cruncher” so before you simply say “no” to any capital request or new initiative that’s put in front of you, bring valuable financial insights to operational decisions. Then learn about all aspects of the business and have deep data insights at your fingertips so you can back up strategic decisions. I highly recommend separating budget reviews from FP&A processes. Use accounting to discuss budget variance, use FP&A as a trusted advisor, and as a result, you will have richer conversations with stakeholders.

The upside of all of this? The ownership of the budget model is more accountable because when everyone has a vested interest, there are less mistakes, more confidence, and a willingness to hit the numbers.

Before joining Phocas as an in-house tech writer, Ali worked as a freelancer and brings a wealth of industry experience to her writing. She previously occupied a senior management position at a national distributor of plumbing and building supplies in the UK. Ali has a genuine passion for writing about ways to help businesses feel good about data.

Related blog posts

If you’re nodding along to this headline, you’re probably interested in finding out how this process can be made reliable and repeatable. Many finance teams need spreadsheets, email trails and offline files to make critical adjustments before reports are ready for the business. It works until it doesn’t. As complexity grows, the gap between your ERP and the final ‘true’ management view widens.

Read more

Asahi Group (a large beverage manufacturer and distributor) recently experienced a cyberattack that didn’t destroy the business, but did create the kind of operational and financial mess most mid-market companies recognize. Orders couldn’t be processed normally, shipments were delayed, call centres were disrupted and some products became temporarily hard to get in retail and hospitality channels. The impact showed up quickly in results. Domestic sales dropped materially for a period while systems were restored and workarounds were put in place.

Read more

Intercompany journals are like transferring stock between two warehouses in the same distribution group. One warehouse records inventory going out at as an internal transfer price, and the other records it coming in. The group hasn’t gained or lost anything — it’s just tracking the internal movement.

Read more

Communicating financial statements effectively is one of the most important responsibilities for finance professionals. Whether you're advising the sales team or preparing updates for board members, you need to meet them where they are. Financial reporting is about ensuring your stakeholders can understand the company’s financial position, profitability and overall financial performance.

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today