SAP Budgeting and Forecasting Software

Steer your business forward with companywide FP&A

Flexible, connected SAP budgeting & forecasting

- SAP Business One [SAP B1]

- SAP By Design

- SAP Hana

- SAP ECC 6

SAP financial planning and analysis

- An intuitive interface worksheet design offers a familiar format to Microsoft Excel spreadsheets

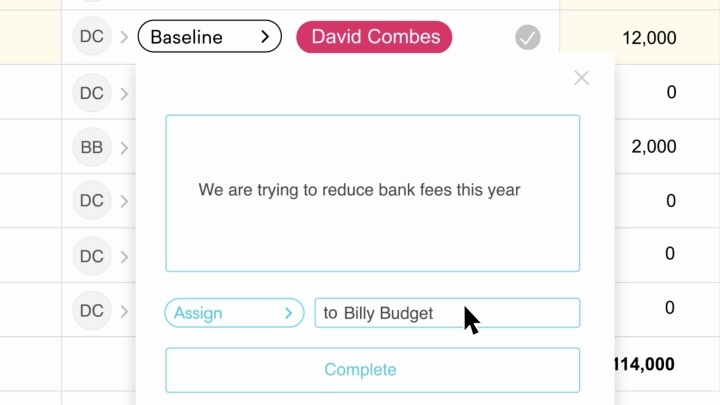

- Swiftly navigate the budget worksheet, securely assign tasks, add commentary to cells, and gain full visibility of changes in real time

- Carry out what-if analysis and scenario planning to streamline decision-making

- Adjust budget drivers and allocations on the fly and encourage more informed decision making

Customer quote

With Phocas, there is more collaboration and more data sharing. People feel empowered, more in control and responsible for their numbers.

Having access to insights frequently means you can make decisions faster and allocate resources correctly.

SAP + Phocas customer

Flexible budgeting and financial management

- Use your profit and loss to drive your balance sheet and cashflow forecasts

- Confidently forecast your future balance sheet position and financial health

- Gain full visibility of cashflow peaks and troughs throughout the year

- Use mini drivers (pre-designed templates covering debtors, creditors and stock) to build accurate forecasts of your balance sheet so your cash flow better reflects reality.

- Adapt your budgeting workflows to suit all your stakeholders

See how Phocas stacks up against the competition

SAP Analytics Cloud vs Phocas

SAP BPC vs Phocas

Anaplan vs Phocas

Board vs Phocas

Jedox vs Phocas

OneStream vs Phocas

Customer quote

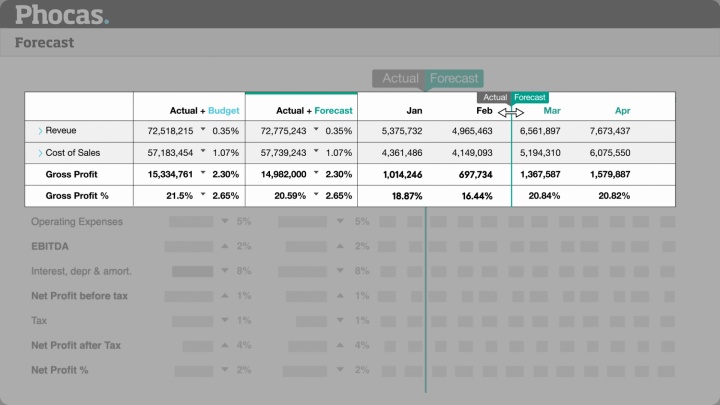

Rolling financial forecasts

- Turn your budgets into living, value-add tools for the whole business

- After a budget model is built you have the next year's data all there

- Link budgets to financial reports and make timely adjustments after month-end

- Visualize and share financial performance so everyone is accountable for results.

Customer quote

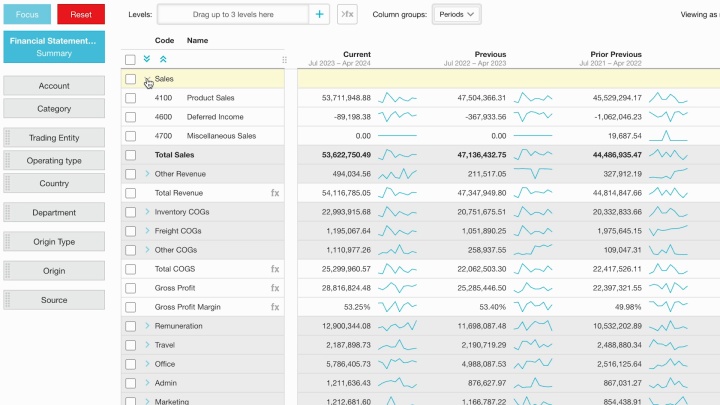

Track dashboards and metrics

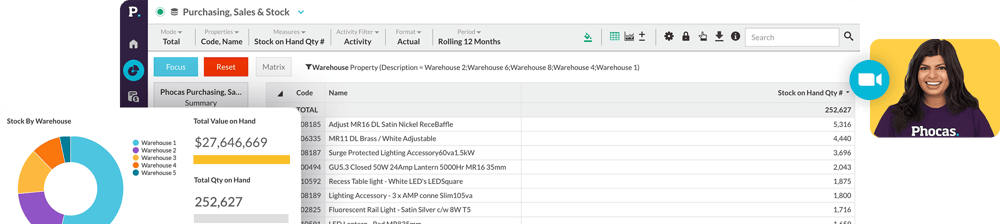

- Drill down into underlying transactions for further interrogation of performance

- Easily make side-by-side comparisons such as year-on-year variances

- Visualizations like sparklines (mini charts) allow you to quickly see trends and spot anomalies

- View budget data in dashboards, to tell and explore your financial forecasting story.

See Phocas Budgeting & Forecasting in action

Phocas offers financial planning and analysis (FP&A) built on a BI foundation.

Move to a flexible, user-friendly planning solution. You’ll find Phocas as easy to use as your trusted excel spreadsheets - just faster and custom-built.

Phocas powers thousands of data-driven companies worldwide

Henry Schein

Henry Schein Bunzl Industrial Safety

Bunzl Industrial Safety Thermo Fisher Scientific Australia

Thermo Fisher Scientific Australia Husqvarna Construction Products

Husqvarna Construction Products Johnstone Supply

Johnstone Supply Stark Group

Stark Group Gazman

Gazman WD-40

WD-40 Hoyts

Hoyts- Monument Tools

- Becker Electric Supply

Steiner Electric

Steiner Electric Guest Supply Sysco

Guest Supply Sysco Seasol

Seasol Sistema

Sistema KYB

KYB Triton

Triton TJM Australia

TJM Australia Nassco

Nassco Baylis & Harding

Baylis & Harding Morelli Group

Morelli Group DMK

DMK Flournoy

Flournoy

Hear why Phocas is revolutionizing the way businesses budget and forecast

Frequently asked questions

SAP offers applications and addons in some of it’s products:

- SAP Business Planning and Consolidation (BPC) is a seperate application that includes forecasting, budgeting, planning and financial consolidation functionality that syncs with SAP ERPs

- SAP Business One includes budgeting functionality that uses data from the general ledger.

- Also SAP CO and SAP Budgeting and Planning for the Public Sector provide different level of budgeting functionality.

A financial plan is a high level, strategic plan for company growth over 1-2 or sometimes up to 10 years into the future. It contains less detail than a budget or forecast.

The budget is a company's financial plan of intent for 12-months. This will incorporate data from finance, operations, sales, inventory and other company information to enable them to set goals and to monitor and manage their finances.

The forecast is a more detailed financial plan for a set amount of time, such as the last 6 or 3 months of the financial year.

Budget forecasting combines the three different processes, when businesses regularly track actual performance numbers and compare them to the budget. Any insights or risks gleamed from this assessment can then be used to re-forecast the remainder of the budget period. This way, potential issues can be mitigated before they become a major risk, or swift action can be taken when responding to rapid economic or environmental change.

Phocas is a financial planning and analysis platform that is designed to be as easy to use and self service as possible. Compared with SAP Analytics Cloud and SAP BPC (Business Planning and Consolidation) in the BARC planning survey 24, Phocas outperformed on all metrics, including reporting and analysis and ease of use. So you can be sure you’re choosing an analytics solution that your whole company can use from day one.

When integrated, Phocas enables companies to manage their operations more effectively in a various ways, such as:

- Data connectivity - Phocas collects and consolidates huge amounts of data from multiple data integrations, empowering SAP ERP users with fast, easy access to real-time data within one platform.

- Custom reporting - Reports and dashboards are customizable to meet specific business needs and can be created by all users. Insights and metrics that may not be readily available in standard SAP ERP reporting tools can be extracted with ease. Design your own reports that offer a deeper understanding of business performance.

- In-depth analytics - a unique ad hoc analysis layer, The Grid, enables all users to perform in-depth analysis. Drill down to transactional level and slice and dice the data in multiple ways such as by customer, branch, product or region.

- High performance - By integrating your SAP ERP with Phocas, you'll achieve lightening fast loading times, regardless of the volume of transactional data stored.

- Companywide adoption - a user-friendly interface enables users across all departments to access and analyze their own data, not just IT experts or data analysts. Enhancing collaboration and informed decision-making.

- All-in-one platform - Along with a BI Analytics foundation, Phocas offers comprehensive financial planning products that work together smoothly, including Financial Statements, Budgets and Forecasts, and Rebates.

For many companies, creating the budget can be an extremely time-consuming process - working with multiple spreadsheets, consolidating input from various departments, version control issues and broken formulas. Incorporating sales and operational data into your budget is often quite complex and requires a lot of collaboration, which is difficult when everyone is working on static spreadsheets.

Phocas Budgeting and Forecasting software dramatically simplifies this because the process is automated. Phocas easily extracts data from your ERP and multiple other sources enabling you to quickly build your budget. Plus, gaining input from finance, operations, sales and inventory is an easy process because everyone is working from the same data source, changes are updated in real-time, and built-in security means you can only access and action what you have been assigned.

When collaborating on the budget is made easy, people will be more inclined to contribute to the process - meaning your finance team is not constantly chasing feedback and more valuable insights are included in your budget from the get go.

With Phocas making budget building easy and collaborative, this paves the way for more accurate, frequent forecasting that's powered by real-time data. Ultimately, Phocas turns budgeting and forecasting into a well-oiled machine that drives business planning, helping you make more informed business decisions for the future.

For more detailed insights as to how Phocas Budgeting and Forecasting can help your business, check out our blog.

When it comes to budgeting and forecasting software, it pays to shop around.

One of the first things to identify is whether the software company can provide a robust and efficient data analytics platform that will enable you to consolidate your financial, sales and operational data. This will provide the gateway to real-time, collaborative budgeting and forecasting.

Cloud-based budgeting and forecasting solutions like Phocas can be integrated with over 200 ERPs, plus multiple other data sources. This enables you to consolidate your data into a single, trusted source of truth. Building the annual budget can then become an automated process, saving the finance team countless hours gathering and consolidating data. Forecasting is also simplified as data automatically feeds into the system, keeping the forecast live. Plus, now that sales, operations and finance are all working on the same file, version control issues and broken formulas will become a thing of the past. The whole process becomes more streamlined and collaborative.

Secondly, the software needs to be easy to use. There’s no point investing in a solution that is not user-friendly to your wider business. If only finance or IT experts know how to navigate and get the most out of the software, other departments will eventually stop using it. The Phocas Budgeting and Forecasting worksheet is designed using a format similar to spreadsheets, so users feel an immediate familiarity with the software. Sales and operations as well as finance can intuitively navigate the system and analyze the budget against actual performance to create better forecasting. This also makes it easy to drill down to transactional-level data, helping you identify potential risks before they become a major issue.

Once you've established these key elements, the best way to get a real feel for the software is to talk with a sales advisor and work through the following:

- Discuss your individual business requirements - including the needs of financial and non-financial users

- Ask for a demo of how the software works

- Establish whether your ERP or other data sources can be integrated with their software

- Ask about their rate of user adoption - this will determine just how easy the software is to use

- Ask about how successfully other companies (in a similar industry to yours) have transitioned into using their software - if possible, arrange to speak to those companies

- Ask about customer support during the initial set up phase as well as ongoing.

If you’d like to learn more about Phocas Budgeting and Forecasting, talk to a sales advisor and book a demo here.

There are several benefits of using financial data analysis platform over Microsoft Excel or other manual reporting methods:

- Time-saving: It frees up the finance team from time-consuming reporting tasks by automating entire processes, allowing for faster reporting, consolidation, and customization.

- Accuracy: Data is pulled directly into the platform which ensures accuracy and reduces the risk of errors that can occur when maintaining and reworking static spreadsheets.

- Standardization: It enforces standardization across financial statements, budgets and reports to ensure consistency and enables comparisons across different periods.

- Collaboration: It enables teams to collaborate and work simultaneously in a secure and auditable environment. This can improve communication and reduce the risk of data discrepancies.

- Reporting: It provides advanced reporting capabilities, such as customizable templates and interactive dashboards. This makes it easier to visualize data and identify patterns and trends.

- Security: It provides better security features than Excel, including data encryption, user access controls, and audit trails. This can help protect sensitive financial data from unauthorized access or modification.

- Customizable: You can add calculations to the statements such as EBITA, margins and ratios

While Excel can be a useful financial reporting tool (and Phocas has easy exporting functionality to Excel), a complete platform of analysis, budgeting and forecasting, and rebates management can help businesses streamline their business processes, improve accuracy, and make better, faster decisions based on real-time data.

Understand the past, operate better today, and plan well for the future