The $500m tech payday that grew out of a dingy backpacker hostel

This article has been reproduced from The Australian newspaper, first published on 27 December 2025. Written by Damon Kitney.

On a bleak English afternoon in 1997, a 23-year-old Australian backpacker named Myles Glashier walked into what looked like the worst youth hostel in the UK.

The smell hit him first, then the mould. The beds sagged and the ceilings leaked in the old decrepit mansion called Raleigh Gardens Backpackers in the south London suburb of Brixton.

Yet Glashier did not walk back out of the door. Instead he entered a profit-share partnership with the owner, an Englishman named Paul Magee, who had a background in software and a knack for making something out of nothing.

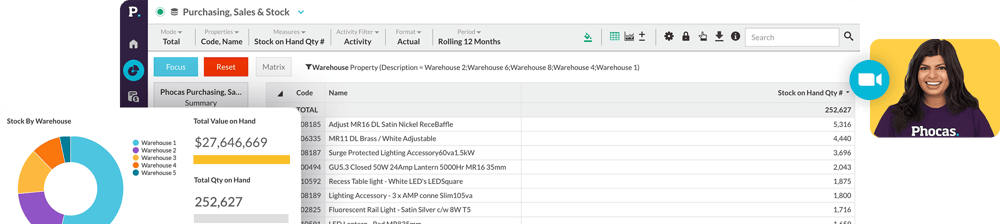

It was the first real business that Glashier had ever run. Four years later they launched a technology firm they named Phocas, selling business intelligence, and financial planning and analysis software to mid-sized enterprises.

Over the next two decades it became one of Australia's most successful global software companies.

During those dark months in the Uk battling bed bugs, broken boilers and budget spreadsheets scribbled at 2am, Glashier and Magee discovered that they worked exceptionally well together. That they could survive stress, chaos, conflict and pressure, and still laugh.

"I really clikced with him, and I sort of said, 'Look, I just don't want to work for a wage. I want to know I can share in the profit,'"Glashier recalls. "Within a year we turned the hostel around. it was 140 per cent occupancy. I won't tell you how we ran 140 per cent because it probably broke every legal and safety limit you could imagine. I had tents in the backyard. I had people living in the basements, but it became a really great business."

It was, while neither of them knew it, the perfect apprenticeship for the next 20 years.

After another year of backpacking around Europe, Glashier returned to the UK an in 1999 joined CBS Steeples, an ERP Software company owned by Magee.

Then in 2001 they started Phocas in the UK. It now has operations in Australia, New Zealand and the US, and employs 300 people worldwide, serving 2800 customers.

In October 2025 Phocas was sold to the US private equity giant Accel-KKR in a transaction valued at more than $500m - a bumper deal that delivered a big payday for Glashier and his co-founders.

Longstanding former chief executive Philip Dodds was also a major shareholder.

Yet despite the eventual financial triumph, the road to the deal was anything but smooth.

For all of Phocas's global success, the truth is less glossy: there were long stretches when Glashier was on the road selling the software more than he was at home, moving between Sydney, London and the US like a man chasing a fast-moving train.

When Accel-KKR came knocking in 2024 and the founders finally agreed to sell, it wasn't just a financial event. It became an emotional rollercoaster ride for Glashier. During the many months he spent abroad during the sale process, his phone kept lighting up with FaceTime calls from his two small children back in Sydney asking, "Daddy....when are you coming home?"

"What I realised is that there is this base level of anxiety that some people might live their whole life with, but I just couldn't do it. I'll never go back to that state where I was in the last two years, because you just can't,"Glashier says.

"You don't realise it until you are out of it. You become a little bit manic, you are distracted, your family doesn't see you and you don't see your friends."

Paul Magee and Myles Glashier

Self-belief

Glashier built Phocas on the basis of the independence and optimism that defined his childhood.

Born and raised in Sydney suburbia, his parents split before he was 10 years old. He spent the subsequent weekdays with his mum and the "zero discipline" weekends with his dad.

He lived in two worlds, both of which shaped the founder he became.

His mother, who worked in hospitality and HR, taught him the people skills that later became his secret weapon in business.

'She would speak to everyone....the cleaners, everyone in the business......So she was really great at the people side,"he says.

His father, a quantity surveyor who embraced computing before it was fashionable in Australia, gave Glashier his earliest exposure to technology.

Between the discipline of one home and the freedom of the other, Glashier developed the two traits every entrepreneur eventually needs: self-belief and adaptability.

"I tend to be a raving optimist. Those years made me who I am and gave me the independence and confidence to get on with it and get things done,"he says.

His final years of schooling at the Australian International Independent School in North Ryde became, in hindsight, a prelude to his founder life.

In contrast to the multitude of public schools where he had struggled, at AIIS he found teachers who cared, classes without uniforms that were personal, and the space to think freely. He rapidly developed from an average to a high-performing student.

After graduating in 1992 he went straight to biotech degree at Macquarie University.

Simultaneously he was working more than 60 hours a week in cocktail bars. He soon realised biotech was not for him.

Before moving to London, he took a detour to Perth, working there for entrepreneur John Sankey.

Then came the backpacking trip, the hotel, Magee and the realisation that he liked building things.

Glashier's first observation while working with Magee's ERP business was simple but profound: their wholesale and manufacturing clients were drowning in data they could not use.

"They had thousands of products, thousands of customers and millions of transactions lines," he says. "They were struggling to maximise revenue because they didn't have good access to data.

"They didn't really know which customers to talk to, what they were buying, what they where not buying and what reps were selling at what margin.So we decided, originally, to build a sales analytics tool for these distributors and manufacturers."

When he returned to Sydney from the UK in 1999, in a spare room in their father's home in Collaroy on the city's northern beaches, Glashier and his brother Angus built the first version of Phocas.

The name came from a book of Catholic saints on his father's bookshelf in which Glashier found saint Phocas, the patron saint of gardeners, agricultural workers, farmers, mariners and sailors.

The product of the new business was simple, intuitive and was sold on a subscription basis from day one.

It's model of simple onboarding and deep integration became the foundation of what is now considered modern SaaS.

But those early years demanded travel across the UK, then Australia and eventually the US.

In 2006, Glashier moved to New York with one goal, and that was to crack America or go home broke.

For years, the Phocas founders deliberately chose to not raise capital, completely bootstrapping their business while maintaining total control.

And they built a profitable global business the hard way, through discipline and refusing to spend money they didn't have.

By 2010 Phocas was generating 50 per cent EBITDA margins on subscription revenue that barely churned, and up to 80 per cent of their deals came from old-fashioned cold calls.

But the US still needed heavy investment and the product needed reinvention.

In 2018, Australian venture capital firm One Ventures became Phocas's first external investor, providing $7m for product development and market expansion.

Four years later, Phocas secured a further $45m to fund the development of its data analytics products in a capital raising led by the Ashok Jacob-chaired Ellerston Capital, which tipped in $35million from its JAADE Fund. One Ventures put in another $10m.

"For the first time ever, we had the option to lose a bit of money, build the products and put our foot down in the US,"Glashier says.

Ellerston JAADE Fund investment director David Leslie says the company knew it was backing a winner in Glashier.

"Myles has built Phocas carefully over many years, using customer revenues to fund growth, not investor capital. This foundation meant the business was built on good economics, so we knew our investment was about driving growth and expanding the market opportunity for Phocas. This thesis played out,"he says.

Angus Glashier, Louise Nash and Myles Glashier

Independence earned

When asked what he has learned from his mistakes over the Phocas journey, Glashier is reflective as any founder who has survived two decades of highs and lows.

He says his biggest lesson was not about strategy but focus.

"I was always chasing solving the technology problems, rather than solving customer problems," he says.

"Just because there is amazing technology, you still need to ask 'What is the problem you are solving with it?'"

If there is a single thread that ties Glashier's life together - the split childhood, the freedom, the pressure, the guilt, the travel and the partnership with Paul Magee-it is the belief that independence is earned, not taken for granted.

Phocas was the ultimate expression of that.

"We kept control of the company for so long. It has been great and I wouldn't do it differently," he says.

Through the long sale negotiations, the uncertainty and the relentless hours, Glashier's thoughts kept returning to his family.

He recalls that a child psychologist had once given him a simple, yet profound insight that he never forgets.

'They said, 'How does a kid spell love? T.I.M.E,"he recalls."That just means time with them."

The simple phrase quietly changed how he thought about his work-balance.

When the deal was ultimately closed, it was a moment of relief after nearly two decades of sweat, risk and relentless focus.

Now, post sale, for the first time in his adult life he is letting himself breathe.

"First of all, it feels freaking great, right? This sense of achievement,"he says."Personally, it feels freaking great for me and and my family to be settled, and we can do some really fun things."

Glashier's focus has already shifted to philanthropy."I felt 10 years ago we had more money than we ever needed. Now we definitely do. So you have an obligation to give back,"he says.

The wealth does, however, create new psychological challenges.

His children will have a very different upbringing to what he had, although he stresses the family has never owned flashy possessions. They prefer instead to enjoy travel experiences.

But even in triumph, Glashier thinks first of his team and the people who helped build Phocas.

"We were generous with the share option plan. About 450 to 500 people had a life-changing amount of money, "he says with genuine pride. "A lot of people come up to me and say, 'Thank you. Myles, I'm a single dad. I can now buy that house, or I can pay off my mortgage.' There has been a satisfaction in really delivering on that and everyone winning through the sale process."

Retaining a meaningful stake in the company, Glashier is already embracing the next challenge.

Having successfully courted Accel-KKR, he remains Phocas's chief executive.

He believes it is different to traditional private equity owners and the stock standard "my way or the highway" approach. Time will tell if he is right.

"I am enjoying this more than I have ever done. I love the learning journey," he says.

"Looking forward I just want to have a great outcome for myself, our people and the new shareholders."

Get in touch with the Phocas communications team by emailing your enquiry below.

Email usUnderstand the past, operate better today, and plan well for the future