Best practices for cash flow forecasting

Whether you are managing inventory or a business owner planning an acquisition, to maintain day-to-day operations you need a clear cash flow forecasting process. Staying on top of cashflow means you can gauge your solvency and profitability from a long and short-term perspective.

If you don't know how much your business earns and spends while making budgeting decisions, it's easy for outflows to overtake cash inflows, leading to shortfalls that push your operation into the red.

The good news is it’s east to improve your cash flow management and use that data to make sound financial planning decisions that ensure the health and stability of your business. The gold standard is 3-way forecasting or three statement modeling, which provides deeper, more comprehensive insights into your future cash flows. Here are some best practices for setting up a cash flow forecasting system and ways to incorporate 3-way forecasting to help you steer your business toward better financial health.

What is cash flow forecasting?

Cash flow forecasting is a financial planning process that involves estimating the future cash inflows and outflows of a business over a specific period. There are two different types of cash flow forecasting, direct and indirect.

Direct method cash flow forecasting closely tracks your expenditures and incoming payments and is often used for short-term management level reporting of net cash flows. It provides a detailed projection of expected cash movements on a daily basis, helping to predict your cash position at any given time. Given the detailed reporting involved, this can be time consuming for for finance teams to generate quickly.

Indirect method cash flow forecasting is used to create less frequent and longer term strategic forecasts that are often used by external stakeholders and investors, and often starts with a historic cash flow statement, with assumptions around variances in revenue and and expenditure that a business will experience over the coming months and years applied to it.

How to forecast cashflow

Whether your performing direct or indirect method cash flow forecasting, start by choosing a specific period and then estimate your receipts and payments, factoring in their timing.

However, the “what” isn’t as important as the “why.”

Suppose your company identifies another, smaller organization that has branches you want to add to your portfolio. You quickly realize that an acquisition would make more sense than investing millions of dollars and thousands of hours in setting up these offices.

But how do you know whether you’ll have the working capital needed to fund the deal or establish financing to make it go through? And what's the best time for the acquisition, so it doesn’t drain your cash and threaten cash-dependent operations?

Using cash flow forecasting, you can approximate how much cash you must put towards an acquisition and how much you should finance. You can also use your forecasts to pinpoint the best time to do the deal so it doesn’t impact your solvency.

In short, cash flow forecasting gives you greater peace of mind, regardless of your business plans. Whether you use long or short-term forecasts, your system can prevent shortages and ensure you have the right amount of cash for your business needs.

Best practices for cash flow forecasting

Using these best practices, you can improve the accuracy of your cash flow forecasting and ensure your data is actionable.

Ensure accurate data collection and automation

The foundation of your cash flow forecasting system is accurate data collection and ongoing updates via automation. The integrated data can include financial information from your ERP system, sell thru data from retail partners, headcount information from your HRIS system and other relevant data sources.

In addition, it’s important to include operational data. This operational data in conjunction with financial data gives you a more comprehensive view of your cash balance.

For example, you can incorporate inventory data in real-time from your ERP. Using this data, you may notice that your inventory reorder points have shifted due to higher turnover rates. This may indicate that you will have to spend more on inventory over the next quarter than you did the previous year requiring reserves in the inventory bank account.

In this way, your ERP and other data sources integrate with your financial planning and analytics (FP&A) software, resulting in a more accurate cashflow forecasting base. By ensuring the data streaming into your system is accurate, you set the stage for more useful cash flow forecasts.

Get the right tools for cashflow forecasting

In a recent Australia and New Zealand Chartered Accountants survey, 28% of respondents don't have the technology to carry out effective cash forecasting. By using FP&A software, you can track actual cash flows and create detailed projections every day or week.

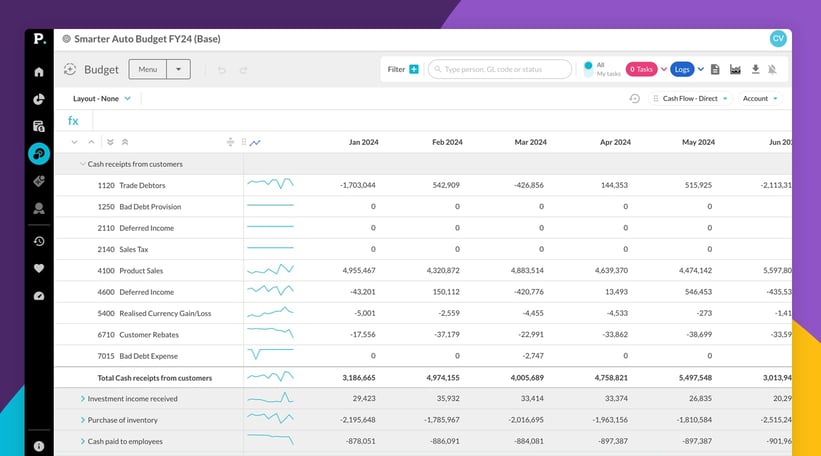

When you build a budget in Phocas Budgets and Forecasts within the BI and FP&A platform, it is linked to the same databases that drive your financial statements and has a built-in forecasting model. So when you reforecast, the changes automatically flow though onto your cashflow statement. You might consider reforecasting when changes to any of these variables occur but the great advantage of a live budget is that you can spot these changes during any period of time ensuring you alway have enough cash.

- Seasonality. Depending on your business, some products or services may have higher—or underwhelming—demand during or leading up to holidays or any of the four seasons.

- Market conditions. Fluctuations in financial markets, interest rates, and even unexpected changes to your regulatory environment.

- Industry trends. As demand, pricing, and preferences change in your industry, the amount of money you receive or spend shifts as well.

- Upcoming major expenses or investments. In addition to factoring in the cost of future investments or expenses, it’s also important to factor in the costs associated with maintaining, repairing, or insuring items or properties you acquire.

Round off with a 3-way forecast

By incorporating all the work from the above two steps into your FP&A platform, you can build a 3-way forecast for cash flow.

Three-way forecasting refers to integrating three financial statements:

- Income statement (profit and loss)

- Balance sheet

- Cash flow statement

Cash flow forecasting primarily focuses on predicting cash inflows and outflows over a specific period. However, 3-way forecasting takes your forecast a step further because it considers how changes in income and balance sheets impact your cash flow.

Your income statement, which is also known as your P&L, gives you a summary of your revenues, expenses, and net income over a certain period. When you use 3-way forecasting, your income statement is the basis for projecting your revenues and expenses, which have a direct impact on your cash flow. Therefore, when you forecast revenue and expenses accurately, you’re able to do a better job of estimating your future cash inflows and outflows.

Your balance sheet gives you a snapshot of your financial position at a particular point in time. It details your liabilities, assets, and shareholders’ equity.

Three-way forecasting factors in changes in items in your balance sheet, and you can use this data to better predict cash flowing into or out of your organization.

For instance, if you have an increase in accounts receivable, this may indicate future cash inflows resulting from collecting the receivables.

On the other hand, if your accounts payable increase, your repayments may affect your cash on hand. Therefore, an increase in payables may indicate future cash outflows as you settle these accounts.

The same could be said of increases in inventory levels. When you must maintain more inventory to support production levels, your cash outflows will likely rise as you pay for more components and materials.

With the right forecasting software, 3-way forecasting is relatively straightforward. For instance, in Phocas Budgets and Forecasts, you can make adjustments to elements of your income statement, balance sheet, or cash flow statement and see how they instantly impact your forecasting methods.

How to use Phocas’ 3-way forecasting for more effective cash flow forecasting

Phocas’ 3-way forecasting tool can automatically adjust your forecast using your integrated data so it takes the time-consuming grunt work out of generating accurate, reliable forecasts. This prevents negative cash flow situations while positioning you to use positive cash flow to fund growth initiatives. Suppose you’re a CFO or finance controller and you realize your average accounts receivable timeframe of 30 days, is not accurate. You can identify this timeframe as a mini-driver in your Phocas software. A mini-driver is a factor that impacts your forecast and three out-of-the-box templates cover common scenarios for debtors (accounts receivable), creditors (accounts payable), and stock. Quickly using the drivers you can then adjust your timeframe from 30 to 45 days.

Phocas then automatically revises your receivables, cash, and cash flow. Instead of combing through excel spreadsheets and adjusting formulas, you can make quick adjustments and see their impact with a few clicks.

After making a change, you can see your adjusted financial statements to review them in the context of your budgetary goals. You also have the option of generating a dashboard that displays your original budget against your revised forecast. In this way, you automatically contextualize your new data, seeing it from the perspective of your original and adjusted cash flow projections.

Returning to the accounts receivable example, suppose after adjusting your timeframe from 30 to 45 days, you see that it results in about 3% less cash on hand six months in the future. However, you’ve already committed to purchasing a new piece of equipment in about seven months, and with a 3% drop in cash, your liquidity may drop below your comfort level.

With Phocas’ 3-way forecasting, you get real-time business analysis that supports a range of informed decisions.

By automating elements of your cash flow forecasting, you increase its accuracy while reducing the amount of work you have to do.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

Related blog posts

Asahi Group (a large beverage manufacturer and distributor) recently experienced a cyberattack that didn’t destroy the business, but did create the kind of operational and financial mess most mid-market companies recognize. Orders couldn’t be processed normally, shipments were delayed, call centres were disrupted and some products became temporarily hard to get in retail and hospitality channels. The impact showed up quickly in results. Domestic sales dropped materially for a period while systems were restored and workarounds were put in place.

Read more

Finance departments in mid-market companies are planning more. Why? Because the market is volatile and competitive, and to stay profitable and keep customers coming back, business planning has become mandatory.

Read more

Financial planning and analysis (FP&A) provides the insights that drive growth, protect profitability and guide new investments. Done well, FP&A transforms raw financial data into scenario models and forecasts, helping finance leaders and business units move ahead with confidence.

Read more

If the owner of your business wants to expand to a new State, would you have the sales forecasting figures to know whether the business can afford to do that or not? Or, if you had to produce a 3–year solvency projection for the CEO, is your sales forecasting process robust enough to support a reliable analysis?

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today