Dynamic vs static financial reporting: key differences

Managers can no longer afford to wait for weekly or monthly financial reports to review business performance; they need to make decisions immediately. Despite this, many businesses are still reporting financial statements in the traditional way — as static PDFs circulated amongst a small group of people. If a stakeholder has any questions about the figures, finding more information from a static report can be difficult as the answers often lie in the data behind the numbers. Worse; a static report only captures the status of the business at the time it was created. So, even the data available through static reporting is limited in its utility to strategize and make decisions.

A better approach than static reporting

Modern leaders both understand that rapid change is the only constant in the business landscape and that adopting the right technology is key to keeping pace with that rapid change. Static reporting hampers business’ ability to remain agile in the face of emerging challenges — that’s why business leaders have demanded and sought out financial reporting tools that support dynamic reporting.

In a dynamic report, the data is interactive. This way, any figure can be investigated, and answers can be found quickly so you can be proactive and move decision-making forward.

If you work on your business's finance team, you'll likely have a hectic workload at the month’s end. For many organizations, the monthly static financial reporting process continues to be arduous, especially if it's still performed manually. It's a time-consuming process and relies mostly on transferring data from the ERP into spreadsheets, with lots of switching back and forth. The process is slow because every new reconciliation affects the numbers, making the static spreadsheet-based reports instantly out-of-date, forcing the regular creation of new versions.

Dynamic reporting makes information accessible rather than locked away in spreadsheets or deep within legacy systems. A finance tech solution that supports dynamic reporting will automatically pull the relevant information from the ERP and present it in a universally accessible format for business users to review, analyze and reference for performance management throughout the month.

Customizable

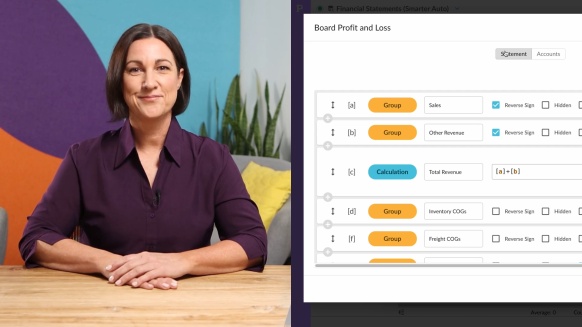

A dynamic reporting tool allows you to create reports specific to the nuances of your business. If you work in a mid-market business that has several entities or divisions, you might have to create various versions of the standardized reports. Dynamic reporting, however, enables you to automate any number of customized reports by content and layout.

Customized financial reports can be generated for any part of the business that needs to manage its own profit and loss (income) statement, balance sheet or financial KPIs. Furthermore, the reports can be automatically updated each month from the ERP data.

The information in the dynamic reporting system is a chart of accounts with an account name and a value next to it. The financial software allows you to group the values in a way that suits your audience.. The data keeps getting refreshed and is presented in the format that your audience is used to seeing. Each report is built once as the layout is saved.

More responsive

When financial reports are dynamic, the CFO can bypass the traditional month-end presentation because the stakeholders can access the information they need at any time. Rather than build custom graphical displays for a month-end presentation, dynamic reports can incorporate responsive design elements that easily demonstrate whether, for example, a division is on target or whether there are any unusual variances in expenses.

Even without a monthly presentation to break down the report, stakeholders across all divisions will have a better understanding of the numbers, as a dynamic report can present timely data in a responsive, more understandable format. For what questions stakeholders have that can’t be answered by playing around with the data directly, the financial team will be able to answer more promptly. Since they won’t be knee-deep generating reports, the financial team will have more time to discuss the findings.

More strategic

Like all others, finance professionals only have so many hours in a day. The more transactional work that can be automated, the more time financial professionals will have available for analysis. Business owners want the finance team to solve problems, find new efficiencies and determine what percentage of products are selling at the right margin. A financial solution backed by data analytics will help them achieve these strategic objectives by automating the lengthy process static reporting demands.

How to shift to dynamic reporting

Financial controllers and CFOs will continue to liaise with the accounts payable and accounts receivable team to close the month; that part won't change when transitioning to dynamic reporting. Getting the data into the ERP will stay the same as well, but reporting that information out of the ERP will be very different. A financial statements solution like Phocas Financial Statements, can automatically pull the critical financial data into a data analytics environment that makes it easier to access, analyze and use the data for reporting.

Ideally, your financial statements solution will work in tandem with your business intelligence software and ERP to facilitate the sourcing and management of data. Phocas Financial Statements, for example, is an add-on to Phocas business intelligence software and integrates with a variety of top ERP systems such as Infor, Epicor, Microsoft, MYOB, Oracle and SAP.

Dynamic reporting might require a different mindset when it comes to financial reporting, but through greater automation, accessibility and responsiveness, it will liberate your financial team to do their work more effectively and give your broader organization greater access to data and insights to inform their strategies.

To find out more about dynamic reporting and financial analytics download this free ebook: Modern financial planning and analysis

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

Related blog posts

NetSuite is a powerful enterprise resource planning (ERP) system, but when it comes to reporting, many finance teams find themselves hitting a wall. Financial and operational reporting is essential for running a business, yet generating timely, accurate and specific reports from NetSuite often requires a heavy lift from finance teams and that’s just the beginning.

Read more

NetSuite, a powerful ERP, promises streamlined operations and robust financial management. Yet, for many businesses, the idea of quick, detailed financial reports often collides with the reality of technical configurations and reporting limitations. The very customization that makes NetSuite so adaptable can become a double-edged sword, leading to a frustrating maze of saved searches and data silos.

Read more

Accounting is one of the oldest professions, with double-entry bookkeeping tracing back to Roman merchants in the 14th century. And the genius of a system in which every transaction is recorded with an opposite entry in a different account continues to be standard practice. Just as accounting emerged during the shift from the Middle Ages to the Renaissance, today’s finance teams must also adapt to new challenges and opportunities.

Read more

For mid-market leaders running a wholesale distribution business, data and business intelligence technology are crucial for monitoring financial and operational performance. However, the real value lies in how your team uses the data insights to influence decision-making.

Read moreBrowse by category

Get a demo

Get a demo Find out how our platform gives you the visibility you need to get more done.

Get your demo today