Collaborative solutions for companywide budget consolidation

If you ask businesspeople who get involved in the traditional budgeting process to describe the experience, we doubt many would say ‘collaborative’. He or she might say the budget is ‘done’ for another year. That's after 10 weeks of intense consolidation, receiving feedback in spreadsheets from the different department heads and once the budget owner has patched them all together into a massive master spreadsheet. An actual collaborative budget solution has in-built mechanisms like workflows, allowing all team members to enter data to direct questions with version control. In other words, data entered by all people involved links to the correct outputs and people can see what others have included and why they have used particular numbers. Want to know more about a collaborative budget solution?

Why budgets need to be collaborative

While it's the finance team's role to oversee a budget, the company budget belongs to all business areas. For instance, for a mid-market HVAC distributor, it is the South Carolina manager who can determine how many Type K Copper Pipes will sell across the 3 branches in his state, and the IT manager decides what projects IT can fund. For a budget to be accurate, it needs to be created from the bottom up, so buy-in is achievable. But when a finance manager controls the budget model via a master spreadsheet, the models is, by definition, managed from the top down. A top-down budget results in a disconnect between the model and the day-to-day activities of a mid-market business and the budget is not often effective.

Are you familiar with the catchphrase, 'we were successful despite our budget?'. A collaborative budget software solution steers away from this mindset and allows a company to make the budget an asset - so it's easy to compare performance with the budget plan and determine adjustments.

Role-based security is possible

Budgets contain highly sensitive information, such as salary levels. A collaborative budget solution allows you to control the data flow to people so they don't receive data that is not related to their role. Phocas budgeting and forecasting has built-in security that finance sets, so certain general ledger codes are only visible to the necessary people

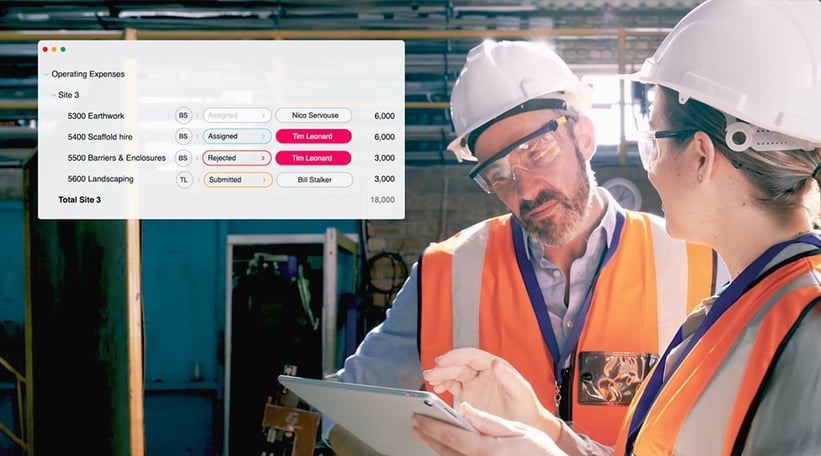

Workflows

In modern budgeting software, the workflows automate and streamline the budget collaboration with an intuitive assignment, submission and approval process for each account code line. The workflows allow multiple people to work in the same worksheet, updating it in real-time, all-seeing the most recent data, and working on the same version. Budget contributors more readily engage in the process, gain a deeper understanding of financial data and are more accountable for their numbers.

Real-time updates

Finally, a collaborative budget must promote self-sufficiency, especially when it comes to updating the budget. Using a modern tool like Phocas budgeting and forecasting enables people to use a direct feed from the ERP to re-forecast estimates during the budget period or prepare a rolling forecast to keep pace with changing market conditions. This means you always have a clear picture of business performance.

A budget model that combines historical information with real-time data is the most efficient way to identify threats and business opportunities.

Do you think it's time to do away with that monster budget spreadsheet your team patches up once a year? Instead, create a valuable budget that lets you combine data from multiple sources to present a single version of the truth. You'll have a dynamic budget that showcases real performance throughout the year that links to the income statement and balance sheet.

Katrina is a professional writer with a decade of experience in business and tech. She explains how data can work for business people and finance teams without all the tech jargon.

Related blog posts

If you’re nodding along to this headline, you’re probably interested in finding out how this process can be made reliable and repeatable. Many finance teams need spreadsheets, email trails and offline files to make critical adjustments before reports are ready for the business. It works until it doesn’t. As complexity grows, the gap between your ERP and the final ‘true’ management view widens.

Read more

Asahi Group (a large beverage manufacturer and distributor) recently experienced a cyberattack that didn’t destroy the business, but did create the kind of operational and financial mess most mid-market companies recognize. Orders couldn’t be processed normally, shipments were delayed, call centres were disrupted and some products became temporarily hard to get in retail and hospitality channels. The impact showed up quickly in results. Domestic sales dropped materially for a period while systems were restored and workarounds were put in place.

Read more

Intercompany journals are like transferring stock between two warehouses in the same distribution group. One warehouse records inventory going out at as an internal transfer price, and the other records it coming in. The group hasn’t gained or lost anything — it’s just tracking the internal movement.

Read more

Finance departments in mid-market companies are planning more. Why? Because the market is volatile and competitive, and to stay profitable and keep customers coming back, business planning has become mandatory.

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today