Strategies for making budgeting and planning more efficient

Every year, you grapple with a long, intense, and tedious budgeting process — and despite your best efforts, the final product isn’t always useful. Traditional budgets performed using only spreadsheets are by nature static documents, prone to errors, lack security, and don’t offer any room for analysis or insights.

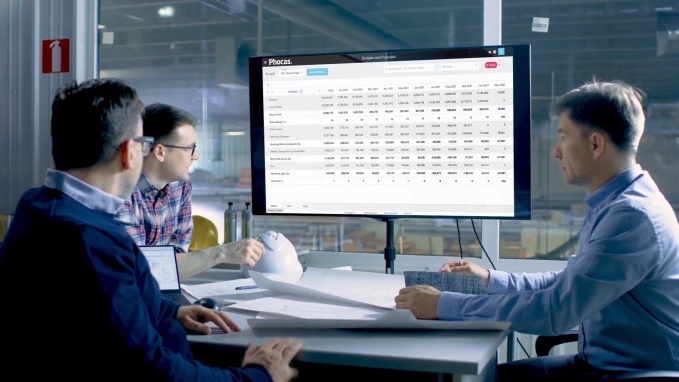

When you switch to a data-driven, cloud-based budgeting solution, you can overcome these hurdles and elevate your budget process so that your entire team can make decisions based on key drivers for your business.

We rounded up the top strategies you should use to streamline your budgeting process, increase efficiency, and drive insights.

1. Use ERP compatible software

If each department works within its own silo, you’re likely missing out on some key data and insights each year when you work on the budget. To complicate matters, you risk holding up the entire process when you reach out to other departments to seek their reports and data.

To increase efficiency, you need your budgeting software to sync with your ERP software and other data sources. That way, all the data you need is in one place, and the time you save on consolidating data from other sources can be better directed to analyzing the data itself.

When your budget software and your ERP link up, you get access to data from throughout the company, enabling you to analyze and use that data to generate business intelligence.

Having one platform also ensures that you never have to worry about incorrect, outdated spreadsheet files circulated around the company. Everyone stays on the same page with real-time corrections and updates.

2. Engage the whole business

When you mention the word “budget” around non-finance folks, you’re likely to hear a chorus of groans. The fact is, your colleagues in other departments feel disconnected from the budget process because they don’t understand the enormity of the task or all the variables involved. To reverse that unpleasant reputation, you need to involve the entire business in the process of building an annual budget.

Software like Phocas allows you to share documents with any stakeholders you choose, offering opportunities for collaboration and engagement with other departments. For example, you can assign certain categories or accounts to individuals for review, which allows each department to have a say in budgeting. Users can also add custom calculations, create dimensions and sub-categories aligned to your industry, and convert numbers and tables into visual charts and graphs on custom dashboards.

Using modern budgeting software, your non-finance co-workers can take advantage of an intuitive, easy-to-use interface and come away with a better understanding of financial data. With built-in security features, only the codes you choose to share will be visible to the right people.

3. Focus on business drivers

Companies that focus on a concrete set of business drivers can spend less time on the overall budgeting process — and end up with more useful data and insights that actually impact their business. Unfortunately, when you work with spreadsheets, your team simply doesn’t have the time to drill down into select criteria. The hours you spend creating reports might not yield any useful information regarding business performance.

Driver-based planning involves identifying a set of factors that are most essential to your company’s success, and creating models that allow you to understand the impact of these factors on projected business results.

Modern budgeting software automatically pulls non-financial and operational data that’s already in your ERP or budget, to do driver-based planning – so you can get a clear picture of what’s going on right now in the business or prepare rolling forecasts.

Ideally, your software can automatically create reports with the insights you need for business planning and forecasting. These dynamic, strategic reports present key data in an easy-to-read format that allows key stakeholders to determine whether the key business drivers are on target and where changes need to be made.

Changing your company’s budgeting and planning process might not happen overnight. It’s best to focus on addressing the most time-consuming and inefficient parts of the process, so you can begin to build your company’s digital transformation from there.

Modern financial solutions offer an easy, quick transition for all skill levels, which adds up to quick rewards for your finance team.

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

Related blog posts

If you’re nodding along to this headline, you’re probably interested in finding out how this process can be made reliable and repeatable. Many finance teams need spreadsheets, email trails and offline files to make critical adjustments before reports are ready for the business. It works until it doesn’t. As complexity grows, the gap between your ERP and the final ‘true’ management view widens.

Read more

Intercompany journals are like transferring stock between two warehouses in the same distribution group. One warehouse records inventory going out at as an internal transfer price, and the other records it coming in. The group hasn’t gained or lost anything — it’s just tracking the internal movement.

Read more

Finance departments in mid-market companies are planning more. Why? Because the market is volatile and competitive, and to stay profitable and keep customers coming back, business planning has become mandatory.

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today