4 ways dashboards provide more insight into financial performance

A dashboard is a tool that allows you to see at-a-glance the performance of your organization. The various widgets on a dashboard are often charts or gauges which help explain complex information. A new financial statement solution backed by the power of a data analytics toolkit is changing the way finance teams carry out month-end reporting and the built-in dashboards provide more dynamic insight into financial outcomes.

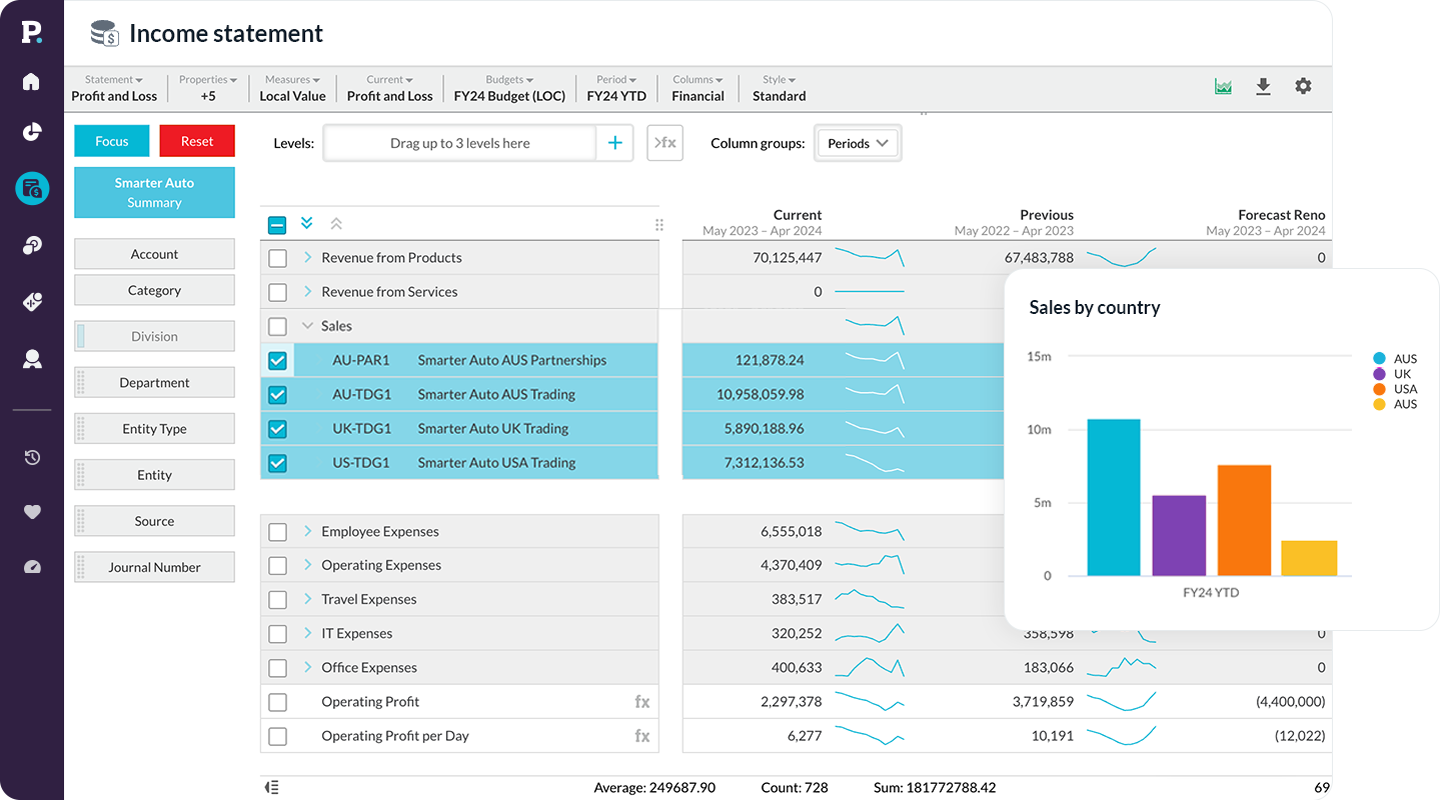

Let’s take a look at a month-end financial dashboard and explain four ways it is improving the review, understanding and interrogation of the numbers in a mid-market business.

1. Charts and tables are easy to reference and spot variances

Using a dashboard to showcase the month-end financial reports will help more people in an organization to visualize financial data in the form of charts or graphs. This way is more natural to uncover patterns, communicate insights, and make data-driven decisions. In this example, the headline information is that gross profit is 10% less than budget. To quickly ascertain why this has occurred, you can see that sales are considerably down. Why? The regions where the business operates have been in lockdown for the month as a result of the pandemic, so customer demand dropped significantly.

2. A subset of data can be visualized for regions or branches

The financial statements solution allows users to customize financial statements to suit the set-up of your business. For instance, if you have three regions you operate in, then most likely three different month-ends for each region (be it UK, USA and Australia) are created. The financial statement tool allows you to set-up these reports once and automate them. Stakeholders can review the group performance dashboard as well as filter to the UK to see the dashboard as it specifically relates to the British business.

3. See the big picture

In this dashboard, all the statements (Profit & Loss, Balance Sheet and Cashflow) have been included on one page so you can quickly see an overall snapshot of the business. The statements each serve a different purpose but seeing them all together is what tells the real story of financial health. In this example, profit is significantly down (Profit & Loss), but what does this mean for the cash? ( scroll to Cashflow). To improve the cash position, then you will review the Balance Sheet. You can investigate whether the debtors are being collected fast enough or perhaps you are holding too much stock (which is in the Balance Sheet).

4. Sharable - quickly email marketing the financials and follow-up

More visibility of financial performance through dashboards leads to better conversations between teams by simply having an easier way to visualize the financial statements. A graph seems like fewer numbers (even though it isn’t) than a financial statement. In this example, we can see that advertising costs have gone up despite the dramatic drop in sales. We can create a sales and marketing dashboard to show marketing spend by month vs revenue by month to see conversion rates and ROI. We can also allow marketers to manage their budget by giving them access to what channels and campaigns money has been spent to date.

By using dashboards, more people understand the numbers which leads to an organic education of non-financial stakeholders and a stronger performing business.

Ideally, your financial statements solution will work in tandem with your business intelligence software and ERP to facilitate the sourcing and management of data. Phocas Financial Statements, for example, is an add-on to Phocas business intelligence software and integrates with a variety of top ERP systems such as Infor, Epicor, Microsoft, MYOB, Oracle and SAP.

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

Related blog posts

Asahi Group (a large beverage manufacturer and distributor) recently experienced a cyberattack that didn’t destroy the business, but did create the kind of operational and financial mess most mid-market companies recognize. Orders couldn’t be processed normally, shipments were delayed, call centres were disrupted and some products became temporarily hard to get in retail and hospitality channels. The impact showed up quickly in results. Domestic sales dropped materially for a period while systems were restored and workarounds were put in place.

Read more

Financial planning and analysis (FP&A) provides the insights that drive growth, protect profitability and guide new investments. Done well, FP&A transforms raw financial data into scenario models and forecasts, helping finance leaders and business units move ahead with confidence.

Read more

Picture a football coach preparing for the big game. He watches game‑tape, studying player metrics, analyzing every play and using real‑time stats to inform strategy. That’s exactly how sales managers and sales leaders should approach their coaching program—with a data‑driven approach.

Read more

Sales professionals operate in face-paced environments with savvy customers who have a lot of choice. Whether you're in B2B sales or working with consumers, the sales process is challenging with longer sales cycles, more decision-makers and higher expectations for follow-up and advice. To stay competitive, sales reps and sales teams need the best sales tools to reduce administrative tasks and improve sales team performance.

Read moreBrowse by category

Find out how our platform gives you the visibility you need to get more done.

Get your demo today