Boost Uniware with real-time business intelligence

Made to enhance Uniware

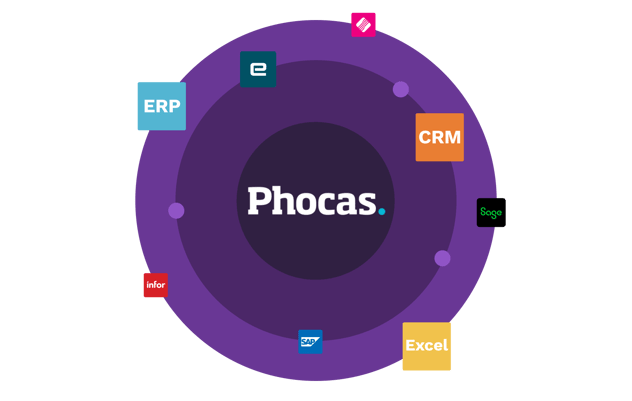

Uniware gives you a solid Enterprise Resource Planning (ERP) foundation, while Phocas adds the purpose-built capabilities of a Business Intelligence and FP&A platform. With AI-assisted analytics, live financials and interactive dashboards, Phocas turns Uniware data into insights you can act on instantly – no spreadsheets or technical expertise required.

Together, Uniware and Phocas deliver an end-to-end solution that provides a connected view of your business. The result is faster reporting, informed decision-making and more time to focus on growth.

- Spend less time compiling reports (or waiting on IT), more time acting on insights.

- Get accurate answers fast, without chasing data every month.

- Reforecast with ease without breaking spreadsheets.

- Involve more people, stay aligned and reduce risks.

Extend Uniware, with Phocas

Uniware

- Data consolidation

Connects core business functions but external data sources require manual handling - User experience

Pre-set ERP reports or exports, often managed by a central team - Inventory management

Standard inventory tracking by SKU or warehouse - Financial reporting

Static ERP reports need exporting & manual manipulation for deeper analysis - Dashboards

Limited native ERP visuals

Phocas

- Data consolidation

Automatically pulls ERP data + other sources (CRM, sales, HRIS, multiple spreadsheets) into one view - User experience

All business users empowered with AI-assisted BI analytics, self-serve custom reporting & planning - Inventory management

Live visual dashboards show trends, gaps, targets vs actuals - Financial reporting

Live profit & loss, balance sheet & cashflow with full drill down - Dashboards

Unlimited, fully customizable interactive dashboards with drill-down to transaction data

| Uniware vs Phocas |  |  |

|---|---|---|

| Data consolidation | Connects core business functions but external data sources require manual handling | Automatically pulls ERP data + other sources (CRM, sales, HRIS, multiple spreadsheets) into one view |

| User experience | Pre-set ERP reports or exports, often managed by a central team | All business users empowered with AI-assisted BI analytics, self-serve custom reporting & planning |

| Inventory management | Standard inventory tracking by SKU or warehouse | Live visual dashboards show trends, gaps, targets vs actuals |

| Financial reporting | Static ERP reports need exporting & manual manipulation for deeper analysis | Live profit & loss, balance sheet & cashflow with full drill down |

| Dashboards | Limited native ERP visuals | Unlimited, fully customizable interactive dashboards with drill-down to transaction data |

| Talk to a Uniware + Phocas expert |

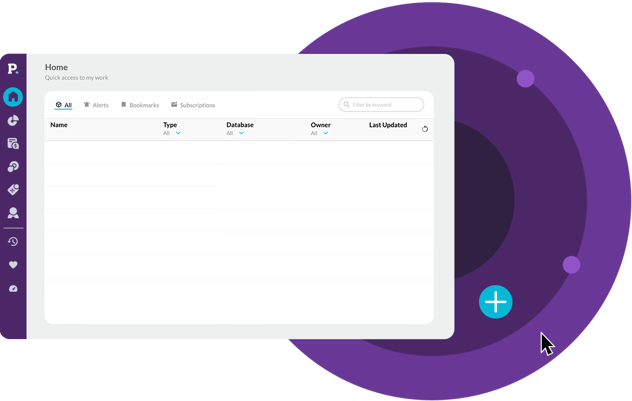

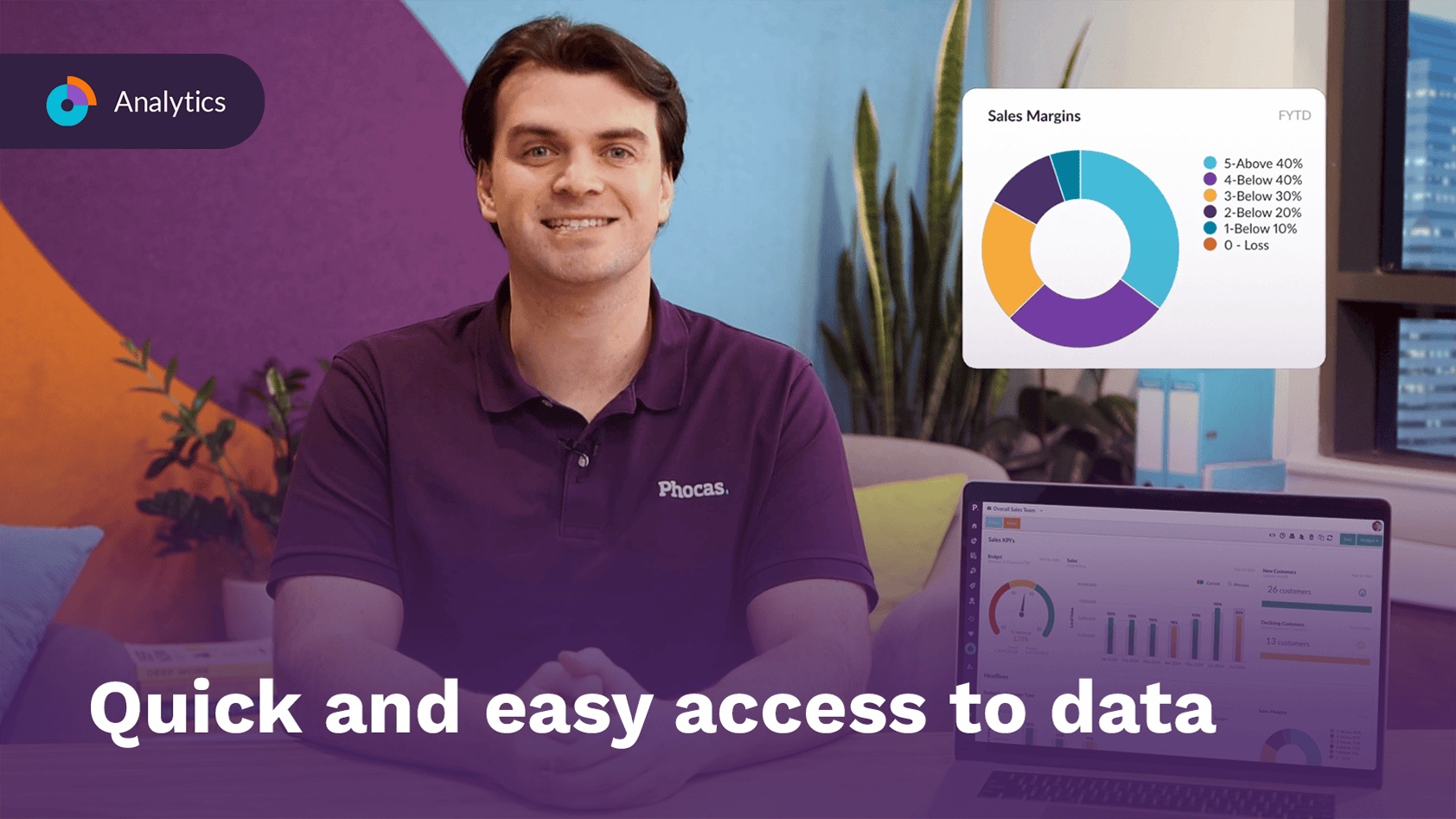

Self-serve analytics & reporting

Like many ERP systems, Uniware includes standard, static reports for operational needs. Generating custom, ad-hoc reports often requires exporting data to Excel or relying on IT support. Phocas complements Uniware by providing a user-friendly analytics layer on top of your ERP data. With Phocas connected to Uniware, everyone can build custom reports, monitor KPIs and explore data in seconds.

- Automation: Live operational + financial data means no more manual entry or re-running outdated spreadsheets.

- Flexible: Create and automate profit & loss, balance sheet and cashflow statements for different departments.

- Real-time insights: Monitor KPIs across departments, save as favourites and set up ongoing alerts.

- Detailed visibility: slice and dice data, drill down by branch, division, sales rep or product for instant answers.

- Custom calculations: Add metrics like gross profit per sales order or inventory days on hand that auto update.

Customer quote

Fast, accurate data

- Automated: Live data is pulled from your Uniware ERP modules, multiple countries, warehouses, accounting systems or even additional ERPs – into one source of truth.

- Reliable performance: Handles big data volumes without lag.

- Secure: Data is accessible to everyone who needs it, while finance maintains employee-level security to protect sensitive information.

- Migration: quick to implement, providing uninterrupted dataflow, reporting, dashboards even during ERP migrations, upgrades or IT transitions.

- AI-assisted Analytics: fast-track data analysis for new users by asking questions like; ‘Which products had the highest increase in sales last quarter?’

Take a Phocas product tour

-

Analytics

Analytics -

Financial Statements

Financial Statements -

Budgets & Forecasts

Budgets & Forecasts -

Platform

Platform

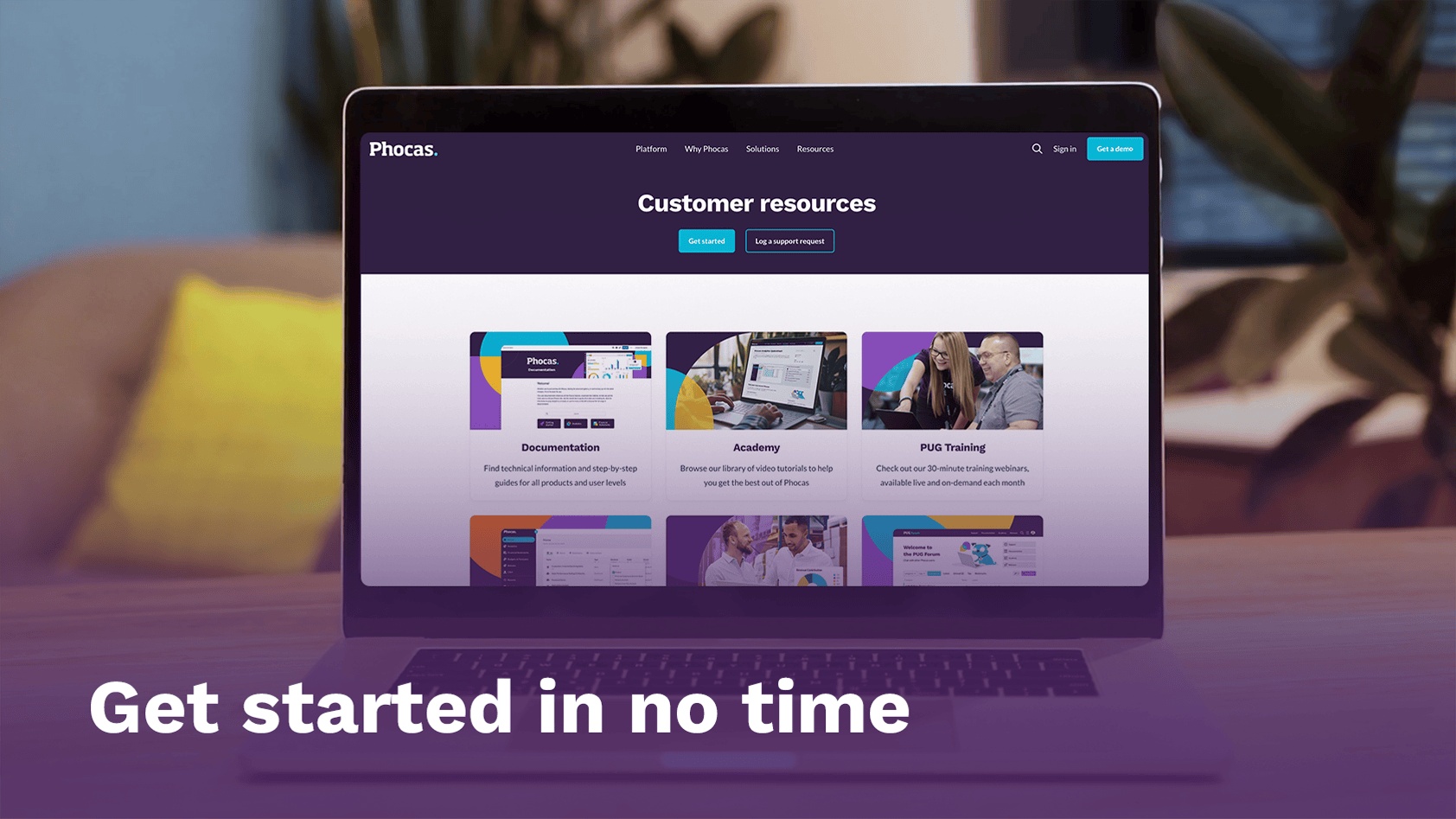

Fast implementation, rapid ROI

- Dedicated support: An implementation team is assigned to work alongside your business to deliver a tailored, pre-built solution, ensuring smooth onboarding.

- Experienced integration: Pre-built connectors for leading ERPs; Uniware, Klipboard, Sage, SAP, Infor, NetSuite, Epicor + many more to align with your existing technology.

- Secure data: Benefit from secure data warehousing for multiple sources - gain a central, reliable data platform for your growing business needs.

- Accelerated insights: Begin harnessing meaningful insights in approximately 8 weeks for a mid-size business, enabling you to fuel growth sooner.

Clear, reliable implementation timeline

-

Pre-launch

Week 1Meet Phocas team and confirm project scope, data sources and timelines

-

Build

Weeks 2-4Create your Phocas cloud environment and connect to ERP data

-

Validation

Weeks 3-5High-level validation and tests

-

Launch

Weeks 6-8Ongoing data validation training and launch

-

-

Pre-launch

Week 1Meet Phocas team and confirm project scope, data sources and timelines

-

Build

Weeks 2-4Create your Phocas cloud environment and connect to ERP data

-

Validation

Weeks 3-5High-level validation and tests

-

Launch

Weeks 6-8Ongoing data validation training and launch

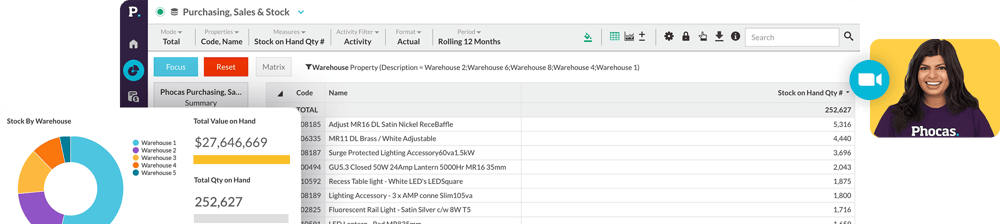

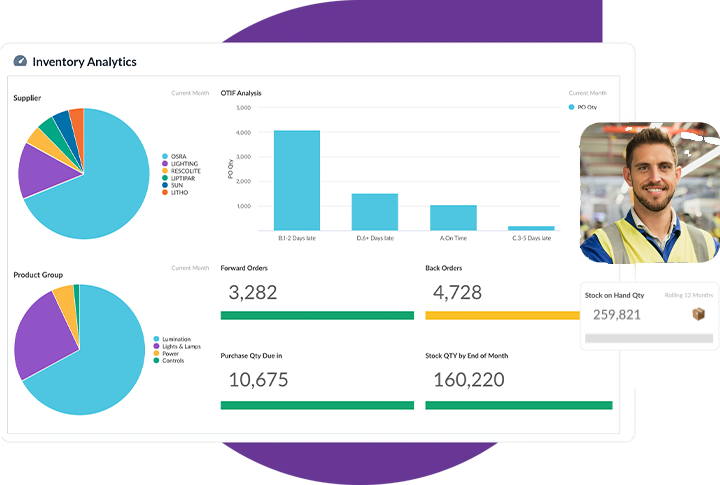

Boost inventory management

Uniware handles the day-to-day of inventory management, warehouse management and sales orders, while Phocas turns that data into forward-looking insight. Together, they help you shift from reactive fixes to proactive planning — optimizing pricing, balancing inventory levels and improving forecast accuracy to reduce costs and boost fulfillment.

- Inventory control: Monitor stock levels across warehouses, stores, sales channels with real-time views of inventory movement and self-serve reporting.

- Forecast demand: Use Uniware data to analyze seasonal patterns, budgets and sales history to accurately predict replenishment requirements months ahead.

- Track: Analyze shipping and delivery time periods, then align suppliers with the most efficient and cost-effective routes.

- Maximize profitability: Accessible live data enables you to align purchasing with sales velocity and margins.

Detailed tracking of inventory movement

"Phocas has helped us to analyze stock that isn't moving or is moving slowly, so we can move stock around to make the best use of it. This also helps us ensure our suppliers are stocking the right products for us or to plan our deliveries proportionately."

— Mark Law, IT Director at Hayley Group.

Streamline budgets & forecasts

Uniware provides the basics for financial planning, with budgets and forecasts built from core ERP data. But most planning is done through static reports and spreadsheet exports, which limits flexibility and makes forecasting slow and manual. Phocas brings planning to life by connecting directly to Uniware and turning financials into a dynamic, collaborative process.

- Flexible: Build detailed financial, sales and operational budgets in a familiar, spreadsheet-like interface – no manual errors and version control issues.

- Automated: Live Uniware data feeds every budget and forecast, so numbers stay accurate and always up to date.

- Collaborative: Assign tasks, gather input and approve budgets across departments in one central place.

- Connected: Link financial budgets with sales forecasts, headcount plans and demand planning for a complete view of performance.

Scale faster with Phocas

When growth demanded more from the finance team, US manufacturer IMMY chose Phocas over additional hires. The result? Faster reporting, streamlined divisional budgets and confident data-driven decisions – like acquiring another company and restructuring departments.

Phocas helps IMMY move fast with accurate, consolidated data, live budgets and powerful scenario planning.

Customer quote

Trusted by companies worldwide

The Phocas platform empowers 2,900+ businesses who make, move and sell products. 97% of customers stay with us year-on-year because our platform gives people confidence to run their businesses better.

- Asko

- Bayer

- Bupa

- Fuji Xerox

- Gazman

- Repco

- Sistema

- Thermofisher

- Hoyts

- KYB

- Husqvarna

- Johnstone Supply

- Karcher

- WD-40

- Yamaha

- Bunzl

See how Phocas compares with other providers

Power BI vs Phocas

Tableau vs Phocas

QlikView vs Phocas

Looker vs Phocas

Sisense vs Phocas

Jedox vs Phocas

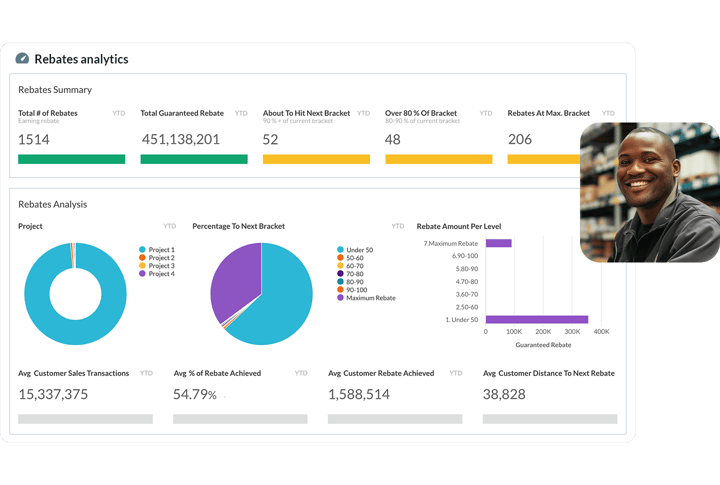

Boost rebates profitability

- Automated: stay on top of payable and receivable rebates with a self-serve tool that speeds up rebate management

- Accurate: prevent overpayments or under claiming rebates with real-time data and automated calculations

- Improved analysis: review rebate programs including structure – are they driving sales, and view impact on profit and margin in one place

- Win-win partnerships: track customer target accruals, use near-miss analysis, explore ‘what if’ scenarios and showcase potential earnings in person

Accurately forecast demand

- Detailed: analyze patterns for different market segments such as customer demand by product class, geography, sales channel, purchase history

- Reforecast: easy access to live actuals empowers teams to adjust forecasts to align with changing inventory needs

- Seasonal: tap into historical data and analyze your seasonal sales trends to create more accurate inventory forecasts

- Review: easily review your forecast accuracy by comparing it to actuals

An end-to-end platform to boost Uniware

Frequently asked questions

Yes - Phocas specializes in combining business data, most often ERP and financial data, with other non financial data sources. Providing one trusted platform to measure, track and plan your ongoing business operations quickly and easily.

Phocas started as a BI solution, so we understand the ins and outs of data manipulation. Our customers loved the enhanced capabilities that Phocas brought to their ERP that they started asking for financial analysis and budgeting and forecasting capabilities too.

Our focus is creating software and tools that anyone in your organization can use to understand sales, operations and logistics, making sure that your team can plan and forecast based on a solid foundation of trustworthy data.

Data analytics, or business intelligence (BI), is the process of interpreting key business data to understand how an organization is performing, both financially and operationally.

Data analytics software is designed to retrieve, analyze, transform, and report on business data and metrics. This software provides organizations with an integrated view of their overall business by combining multiple data sets, such as enterprise resource planning (ERP) systems, CRM, HR, Payroll and e-commerce. BI can also be used to identify trends, uncover insights, and make informed business decisions.

This is the process by which businesses regularly plan, review and control their finances.

The budget is a company's financial plan of intent for 12-months. This will incorporate data from finance, operations, sales, inventory and other company information to enable them to set goals and to monitor and manage their finances.

The forecast is a more detailed financial plan for a set amount of time, such as the last 6 or 3 months of the financial year.

Budget forecasting is when businesses regularly track actual performance numbers and compare them to the budget. Any insights or risks gleamed from this assessment can then be used to re-forecast the remainder of the budget period. This way, potential issues can be mitigated before they become a major risk, or swift action can be taken when responding to rapid economic or environmental change.

When you’re armed with this information in real-time, you have more control of your financial position throughout the year. It also enables you to take take action to avoid greater risks in the long term, while at the same time helping you to achieve your business goals.

Financial statement software is a program designed to automate the process of creating reports such as profit and loss (income statement), balance sheet and cashflow statements. It achieves this through the extraction of real-time data from ERP, CRM and multiple other data sources, and helps to ensure accuracy, consistency, and compliance with accounting standards.

Statements are fully customizable to suit your business needs with an intuitive interface that enables free-form data analysis. Visualizations such as dashboards, graphs, charts and Sparklines also help to connect the wider business to performance as it's easy to provide an at-a-glance view of your finances.

There are several benefits of using financial data analysis platform over Excel or other manual reporting methods:

-

Time-saving: It frees up the finance team from time-consuming reporting tasks by automating entire processes, allowing for faster reporting, consolidation, and customization.

-

Accuracy: Data is pulled directly into the platform which ensures accuracy and reduces the risk of errors that can occur when maintaining and reworking static spreadsheets.

-

Standardization: It enforces standardization across financial statements, budgets and reports to ensure consistency and enables comparisons across different periods.

-

Collaboration: It enables teams to collaborate and work simultaneously in a secure and auditable environment. This can improve communication and reduce the risk of data discrepancies.

-

Reporting: It provides advanced reporting capabilities, such as customizable templates and interactive dashboards. This makes it easier to visualize data and identify patterns and trends.

-

Security: It provides better security features than Excel, including data encryption, user access controls, and audit trails. This can help protect sensitive financial data from unauthorized access or modification.

- Customizable: You can add calculations to the statements such as EBIT, margins and ratios.

While Excel can be a useful financial reporting tool, a complete suite of analysis, financial statement and forecasting tools can help businesses streamline their financial reporting processes, improve accuracy, and make better, faster decisions based on real-time data.

Understand the past, operate better today, and plan well for the future