Utilize financial analytics to ensure mergers & acquisitions success

According to Reuters, merger and acquisition deals have seen a record boom this year due to low interest rates and high stock prices. Around 35,000 deals have been announce already, a jump of 24% over last year, and the total value of M&A deals has reached over $3.6 trillion dollars, already surpassing the total amount in 2020.

Aided by the need to readjust business models in a post-pandemic world, organizations are more actively exploring M&A options. Whether you are on the buying or selling side, mergers and acquisitions can be extremely lucrative options. But successful mergers and acquisitions require lots of due diligence and your time and resources could be being wasted if you’re not taking the proper steps.

Eliminate guesswork on important valuations

Mergers and acquisitions are often valued on a multiple of the company’s EBITDA. To ensure the accuracy of these valuations, and that this number is not inflated, means you need access to lots of financial data to analyze the company’s financial performance. Since this data could be coming from multiple different sources it can be a daunting task if you’re lacking the right solution.

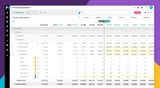

Phocas makes it easy to bring in data from multiple sources and transform it from static data to data that is updated daily, so you always have a clear picture of performance. With an intuitive Phocas interface, you can access all the information you need at the click of a button.

Achieve greater data visibility

Phocas lets you go deeper into your data. Users can review not only a company’s financial records, but the data behind the records as well such things as customer and inventory concentration, and inventory turn, to salesperson performance, product pricing and vendors. This transactional data gives a better idea of business operations and revenue generation. Best of all, this visibility into the data means you’re not going back and forth with questions to the M&A company in question, avoiding any disruption to the business.

Having the ability to easily drill down deeper into this company data can lead to a more comprehensive overview of how the company is performing. It’s a unique feature that Phocas customers love since it helps to answer the “why” behind their questions and provide the clarity they need for better decisions.

Trade Supply group relies on Phocas to evaluate acquisitions

New York-based building supplier Trade Supply Group has grown the last several years through acquisition. Central to its acquisition strategy is Phocas Analytics software, which the company uses to evaluate acquisition candidates’ assets, and then streamline the integration of financial and operations data from candidates once they are acquired.

“Phocas helps us to complete the due diligence on prospective acquisitions and then clean their data for a smooth conversion to our ERP system,” said Nick Aversano, vice president of operations for Trade Supply. “[The] level of analysis shows important trends and can potentially lead to better product pricing for all of our businesses, as well as reveal details that didn’t necessarily show up in our financial analysis.”

Phocas offers a flexible user-friendly solution that makes it simple to import multiple data streams for quick analysis that can accelerate an acquisition. Phocas simplifies the conversion of the new acquisition’s data into the collective’s ERP system, and then empowers decision makers with the data access and analysis capabilities they need to better manage their areas of responsibility.

Thomas merges his love of data and marketing at Phocas. He is keen to learn more about customers application of analysis to different data sets.

When to use an operating budget for more detailed planning

What is an operating budget? An operating budget is a resourceful tool that enables businesses to estimate income projections and expected expenses and plan for low-earning or high-spending months. This financial plan provides data that constantly records the costs of your business operations for a specific period (mainly up to the end of the year). It also serves as an outline detailing how much money a company spends and incurring expenses.

Read more

Best practices for cash flow forecasting

Whether you are managing inventory or planning an acquisition, to maintain day-to-day operations you need a clear cash flow forecasting process. Staying on top of cashflow means you can gauge your solvency and profitability from a long and short-term perspective.

Read more

Improve planning with comprehensive sales forecasting

If the owner of your business wants to expand to a new State, would you have the sales forecasting figures to know whether the business can afford to do that or not? Or, if you had to produce a 3–year solvency projection for the CEO, is your sales forecasting process robust enough to support a reliable analysis?

Read more

What is financial modeling and common models to know

Predicting the future is a daunting task, unless you possess a time machine like Marty McFly in the 1985 film, 'Back to the Future'. If you don’t have such a tool, the next best thing is financial modeling. It can offer valuable insights and guidance into the future financial position of your business.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today