How to monitor business performance with financial analytics

The finance department monitors and analyzes business performance in detail. Yet sometimes it can take awhile to communicate and address issues occurring in different parts of the business that are creating bottlenecks or affecting costs. Companies spend months preparing budgets and yet when the numbers are reviewed a year later a company's performance isn’t always aligned. To get the maximum benefit from your financial data, using dynamic reporting tools in data analytics software will allow you to better monitor performance metrics, visualize the numbers and deal with 'unexpected' issues.

Create budgets using data analytics

A good performance management plan helps develop and promote a business. Without clients and sales, there is no income, so strategies and budgets are mostly oriented to them. The benefit of creating budgets in a data analytics environment is that you have all the data from the previous periods so you can better predict the outcomes of the following year and account for seasonable trends – you know the summer sales in Northern Hemisphere are less than in other months because you have the data, so the software accounts for this automatically.

Many companies do not anticipate the impact of expenses when they incur but data analytics tools enable budget management to be turned on its head. It becomes a strategic play for reducing costs and to clearly monitor defined budgets.

By automating financial processes like the development of budgets and financial statements, upstream identification of the impacts of expenditure, and coupling with the purchasing process, a data analytics solution can improve your financial management in real-time.

Move the needle of business performance

Achieving significant economies of scale is hard once a business has reached a certain level and often it’s in the data and back office function that you find the new efficiencies. Budget monitoring is a good technique to move the needle on business performance. If you are an administrative and financial director, budget manager or accountant, budget management for business performance is among your primary goals. There are different data analytics plus financial solutions on the market. Phocas is one of them. To determine which financial management software will suit you best, you need to look at several criteria – what tasks do you want to automate from your current process, what do you need to customise to suit your business, what reports do you need to deliver and what advanced analytics would you like to carry out. These are all good places to start.

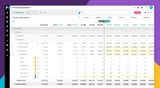

Tools such as Phocas data analytics let you explore your data, perform useful analyses, create interactive dashboards, and generate crisp reports. You can combine self-service for business users with enterprise-wide data governance.

You may also want to consider a financial exercise you're planning, such as the best way to utilize credit. To do this in Phocas analytics you’d look at 'return on assets'. It is a common indicator to measure profitability and identify the best ways to utilize credit. It is calculated by dividing net income by average total assets. The higher the return on assets, the more efficiently the company uses its assets to generate profit. This financial KPI is generally essential for banks or investors, as it provides a good insight into how well a company is using the assets made available. It is always useful to compare these KPIs to similar companies, as this metric varies a lot between industries.

The lower your company’s operating costs versus revenue, the more profitable it is. Phocas helps companies to analyze operating costs in detail and to derive optimization measures. These key figures are useful when benchmarking your company with competitors and often reveal potential savings.

Ideally, your financial statements solution will work in tandem with your business intelligence software and ERP to facilitate the sourcing and management of data. Phocas Financial Statements, for example, is an add-on to Phocas business intelligence software and integrates with a variety of top ERP systems such as Infor, Epicor, Microsoft, MYOB, Oracle and SAP.

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

When to use an operating budget for more detailed planning

What is an operating budget? An operating budget is a resourceful tool that enables businesses to estimate income projections and expected expenses and plan for low-earning or high-spending months. This financial plan provides data that constantly records the costs of your business operations for a specific period (mainly up to the end of the year). It also serves as an outline detailing how much money a company spends and incurring expenses.

Read more

Best practices for cash flow forecasting

Whether you are managing inventory or planning an acquisition, to maintain day-to-day operations you need a clear cash flow forecasting process. Staying on top of cashflow means you can gauge your solvency and profitability from a long and short-term perspective.

Read more

Improve planning with comprehensive sales forecasting

If the owner of your business wants to expand to a new State, would you have the sales forecasting figures to know whether the business can afford to do that or not? Or, if you had to produce a 3–year solvency projection for the CEO, is your sales forecasting process robust enough to support a reliable analysis?

Read more

What is financial modeling and common models to know

Predicting the future is a daunting task, unless you possess a time machine like Marty McFly in the 1985 film, 'Back to the Future'. If you don’t have such a tool, the next best thing is financial modeling. It can offer valuable insights and guidance into the future financial position of your business.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today